WTI Crude Futures - Time to Enter Short Positions

rhboskres

Publish date: Thu, 12 Jul 2018, 05:23 PM

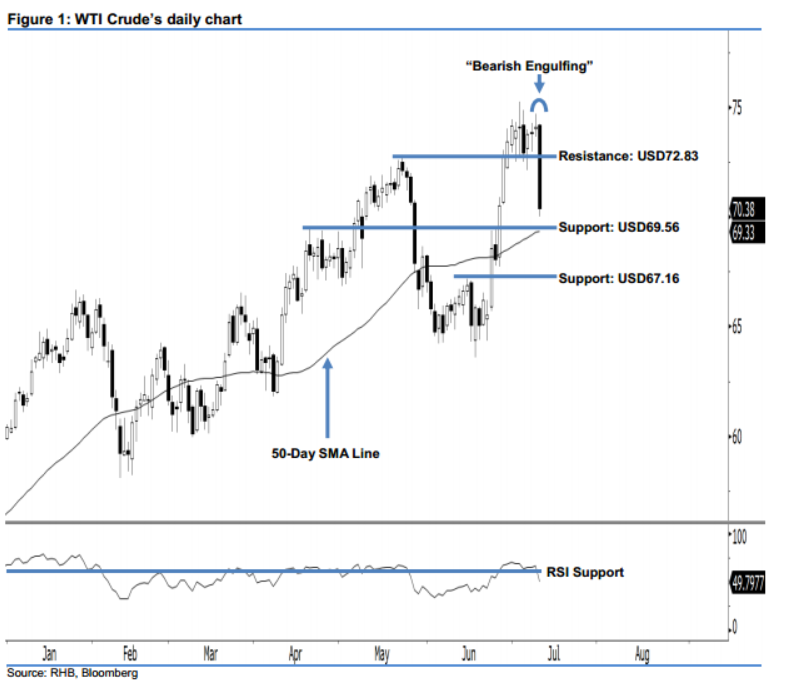

Initiate fresh short positions as bears are now in control. Last night, the WTI Crude plunged USD3.73 to USD70.38. This is the biggest YTD loss recorded in a single trading session, which has wiped away all the gains we saw over the last nine sessions. As a result, the commodity charted a long black candle that breached firmly below the previous USD72.83 support level, and formed a “Bearish Engulfing” candlestick pattern. This shows strong downside development, indicating that the bears finally wrested control from the bulls. We also note that the 14-day RSI indicator has dipped below the 50-pt neutral level at 49.80 pts – an indication that market sentiment has turned weak. Overall, we believe opportunities are more towards sellers now.

Although our previous USD69.56 trailing-stop has not been taken out, we think it is best that traders turn to short positions and exit the current long one. For risk-minimisation purposes, look to USD72.83 as the stop-loss. Note that by exiting the current long positions at this level, some of the trading profits are secured.

Our immediate support is now at USD69.56, which was the high of 17 Apr. If this level is taken out, the following support is seen at USD67.16, or the high of 14 Jun. On the flip side, we revise the immediate resistance to USD72.83, which was the high of 22 May. This is followed by the USD75.84 resistance threshold, which was derived from the low of 4 Nov 2014.

Source: RHB Securities Research - 12 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024