FBM Small Cap Index - Bulls Are Still Running

rhboskres

Publish date: Tue, 17 Jul 2018, 11:44 AM

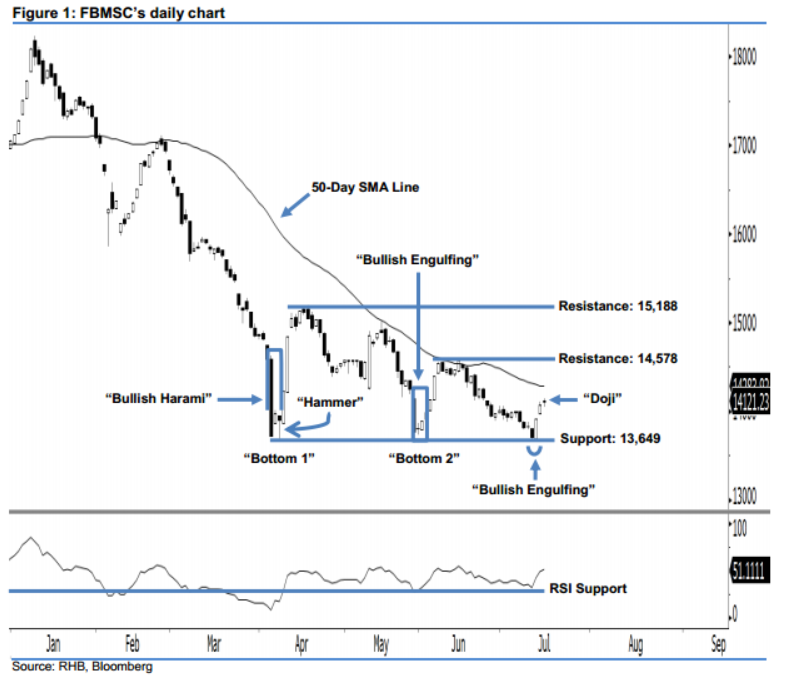

Index may still inch higher, in line with the ongoing bullish bias above 13,649 pts. The FBMSC posted a 92.50-pt increase to 11,377.50 pts yesterday. A “Doji” candlestick pattern was formed after it oscillated between a low of 11,302.50 pts and high of 11,562.50 pts. Technically speaking, this shows that neither bulls nor bears were able to take control at the end of the day. The index continues to hover above the 13,649-pt mark and, as long as this level is not firmly taken out, we believe the bullish bias that started since early April remains in play. Overall, our positive view remains intact.

Based on the daily chart, we see a high possibility of a “Triple Bottom” bullish reversal pattern appearing, provided the FBMSC continues to climb higher in coming sessions. Meanwhile, market sentiment shows an improvement in strength – this is because the 14-day RSI indicator has successfully breached above the 50-pt neutral level at 51.11 pts.

To the downside, we set the immediate support at 13,649 pts, which was the low of 30 May. The next support is found at the 13,116-pt threshold, or the low of 25 Aug 2015. Conversely, our immediate resistance is pegged at 14,578 pts, ie at the high of 14 Jun. This is followed by the 15,188-pt resistance, which was derived from the high of 17 Apr.

Source: RHB Securities Research - 17 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024