E-mini Dow Futures - Charts Another White Candle

rhboskres

Publish date: Thu, 26 Jul 2018, 09:35 AM

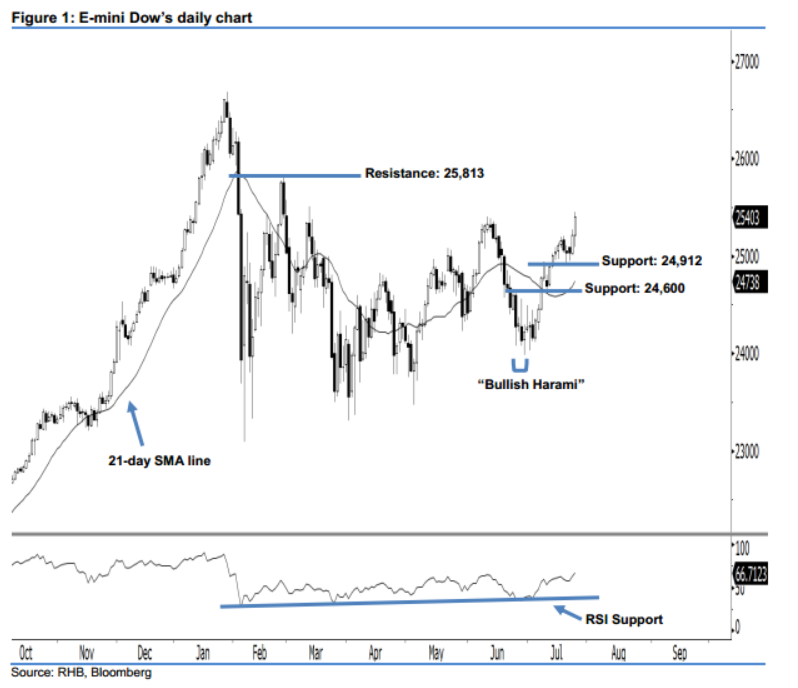

Stay long while setting a new trailing-stop below the 24,912-pt level. The upside strength of the E-mini Dow continued as expected as a long white candle was formed yesterday. It gained 189 pts to close at 25,403 pts, off its high of 25,451 pts and low of 25,088 pts. As the E-mini Dow has successfully taken out the 25,400-pt resistance mentioned previously, this can be viewed as the bulls extending their buying momentum. In view of the fact that the index has posted a long white candle for the second consecutive day, this indicates that the rebound that started off 28 Jun’s “Bullish Harami” pattern may go on.

Based on the daily chart, we are now eyeing the immediate support level at 24,912 pts, determined from the low of 20 Jul. The next support is anticipated at 24,600 pts, situated near the midpoint of 9 Jul’s long white candle. Towards the upside, the near-term resistance level is seen at 25,813 pts, which was the previous high of 27 Feb. This is followed by the 26,000-pt psychological spot.

Recall that on 11 Jul, we initially recommended traders to initiate long positions above the 24,600-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 24,912-pt threshold. This is in order to lock in part of the profits.

Source: RHB Securities Research - 26 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024