WTI Crude Futures - Downside View Continues

rhboskres

Publish date: Fri, 27 Jul 2018, 05:04 PM

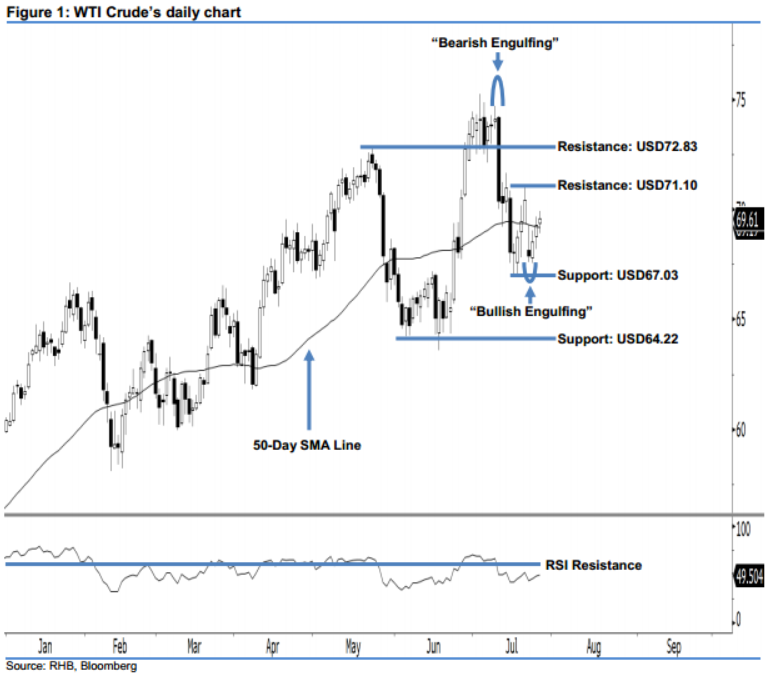

Stay short in line with the weak market sentiment. The WTI Crude inched up USD0.31 to USD69.61 last night. Nevertheless, this does not negate our bearish view. This is because no strong upside development has been sighted yet, despite the momentum in 24 Jul’s reversal “Bullish Engulfing” candlestick pattern. Technically speaking, the buyers are still unable to wrest control from the sellers. Our bearish view is also supported by the fact that the 14-day RSI indicator is fluctuating below the 50-pt neutral level at 49.50 pts – an indication that market sentiment is still weak.

The daily chart above shows that the commodity is still being pressed towards south. As such, it is best that traders maintain short positions. For risk-control purposes, we advise setting a stop-loss above the USD71.10 threshold. For the record, our short call was initially triggered on 12 Jul, after strong selling activities that sent the commodity firmly below the USD72.83 mark.

We keep the immediate support at USD67.03, obtained from the low of 17 Jul. The following support is pegged at the USD64.22 threshold, located at the low of 5 Jun’s “Bullish Harami” pattern. On the flip side, our immediate resistance is maintained at USD71.10, derived from the high of 20 Jul. For the next resistance, look to USD72.83, ie 22 May’s high.

Source: RHB Securities Research - 27 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024