COMEX Gold: Ongoing Correction Stays Intact

rhboskres

Publish date: Mon, 30 Jul 2018, 05:41 PM

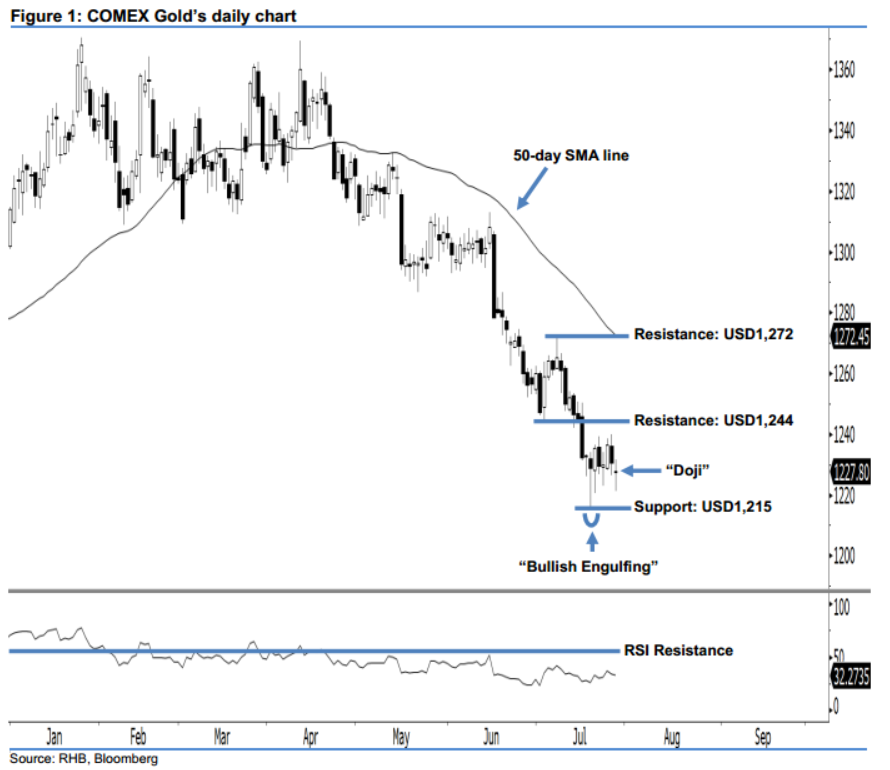

Stay short, as market sentiment remains bearish. The COMEX Gold ended at USD1,277.80 and posted a marginal USD2.70 loss last Friday. It left a “Doji” candlestick pattern after having oscillated between a low of USD1,221.40 and high of USD1,231.50. This shows that neither bulls nor bears were able to take firm control at the end of the day. Presently, the current correction remains intact. Despite the bullish bias in 20 Jul’s “Bullish Engulfing” candlestick pattern, no strong upside follow-through has been sighted. Technically speaking, market sentiment remains bearish.

The daily chart suggests the commodity may still continue to slide once the breather above the USD1,215 mark ends. As such, we advise traders to stay in short positions with a trailing-stop pegged above USD1,244. This is so that parts of the trading profits are secured. For the record, our short recommendation was triggered below the USD1,309 threshold on 16 May.

To the downside, our immediate support is maintained at USD1,215, or 20 Jul’s Bullish Engulfing” pattern. For the next support, look to USD1,207, ie 10 Jul 2017’s low. Conversely, we keep the immediate resistance at the USD1,244 mark, which was derived from the low of 3 Jul. If this level is taken out, the following resistance is pegged at USD1,272, or 9 Jul’s high.

Source: RHB Securities Research - 30 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024