FBM Small Cap Index - the Bulls Are Still There

rhboskres

Publish date: Tue, 31 Jul 2018, 05:44 PM

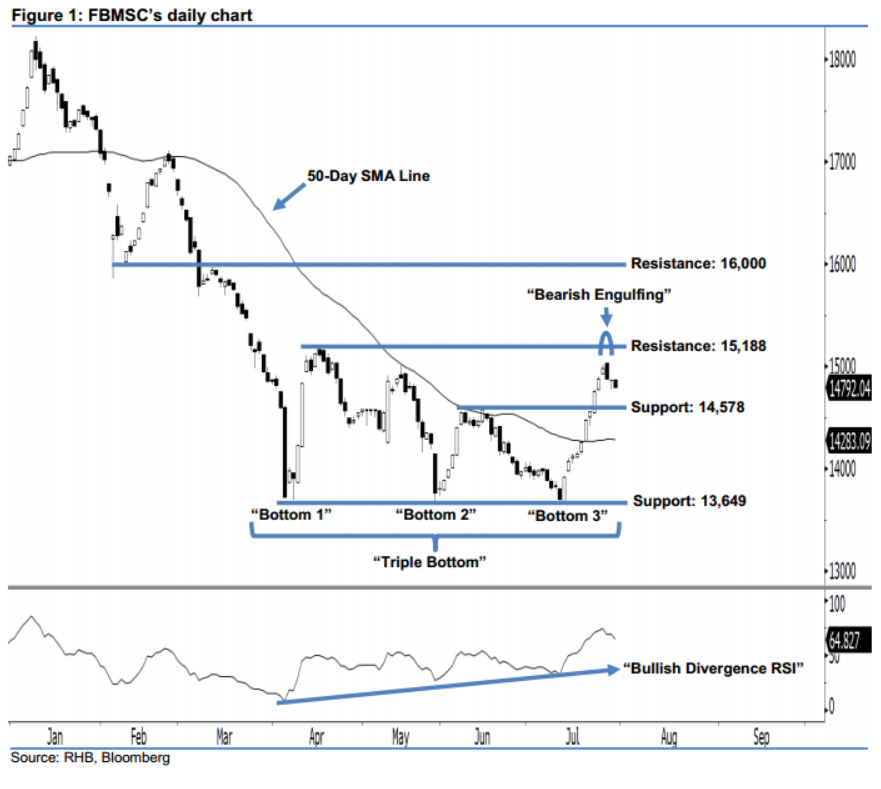

Our positive view remains in play above 13,649 pts. The FBMSC ended 78.60 pts lower yesterday to 14,792.04 pts. It charted a black candle after having oscillated between a low of 14,785.69 pts and high of 14,880.63 pts. This shows a continuation of the bearish bias we detected in 26 Jul’s “Bearish Engulfing” candlestick pattern. Nevertheless, as long as the index does not drop below the 13,649-pt level, we deem the upside development since April as still in play. This is also supported by the encouraging market sentiment, given that the 14-day RSI indicator continues to hover above the 50-pt neutral level at 64.83 pts.

Overall, there is no change to our positive view. The appearance of the meaningful “Triple Bottom” reversal signal suggests that the bulls have taken control from the bears. In addition, the “Bullish Divergence RSI” pattern implies that the trend has changed towards the upside from downside. These positive indicators strengthen our upside view.

Our immediate support is maintained at 14,578 pts, or the high of 14 Jun. This is followed by the next support at 13,649 pts, which was derived from the low of 30 May. Conversely, we keep the immediate resistance at 15,188 pts, ie the high of 17 Apr. Should the FBMSC breach above this level, our next resistance is found at 16,000 pts, which is located near the low and high of 9 Feb and 12 Mar.

Source: RHB Securities Research - 31 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024