COMEX Gold: Best to Stay in Short Positions

rhboskres

Publish date: Tue, 31 Jul 2018, 05:46 PM

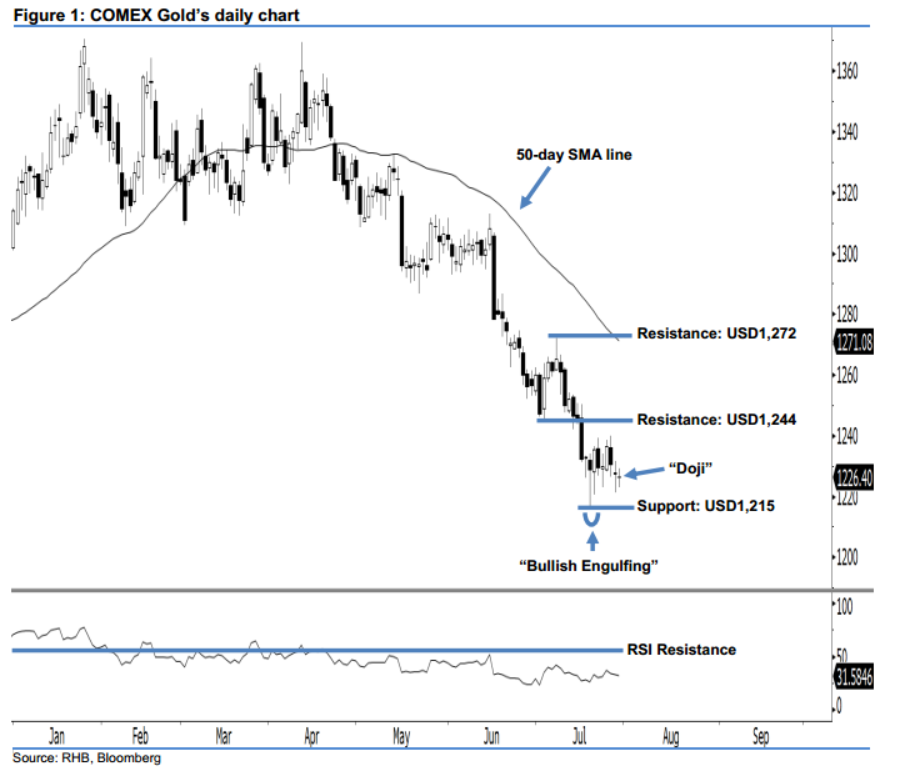

Traders are advised to stay in short positions as the correction is still intact. Last night, the COMEX Gold slipped USD1.40 to USD1,226.40. A “Doji” candlestick pattern was formed, which implied that the session was an indecisive one. Presently, we do not see any strong continuation of the positive momentum in the “Bullish Engulfing” candlestick pattern on 20 Jul. From our technical perspective, the bears are still dominating market sentiment. Looking forward, we think that that correction could still be extended, once the breather above USD1,215 reaches its limit.

As long we do not see a strong shift of trend towards the upside, this implies that the current correction remains in play. As such, traders are advised to stay in short positions. In order to secure part of trading profits, it is best to set a trailing-stop at above USD1,244. Our short call was initially triggered on 16 May, following a breach below the USD1,309 threshold.

We keep the immediate support at USD1,215, which is located at the low of 20 Jul’s Bullish Engulfing” pattern. The following support is found at USD1,207, or the low of 10 Jul 2017. On the flip side, our immediate resistance is pegged at USD1,244, ie the low of 3 Jul. This is followed by the next resistance at the USD1,272 threshold, which was derived from the high of 9 Jul.

Source: RHB Securities Research - 31 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024