WTI Crude Futures - Short Call Remains Valid

rhboskres

Publish date: Wed, 01 Aug 2018, 05:49 PM

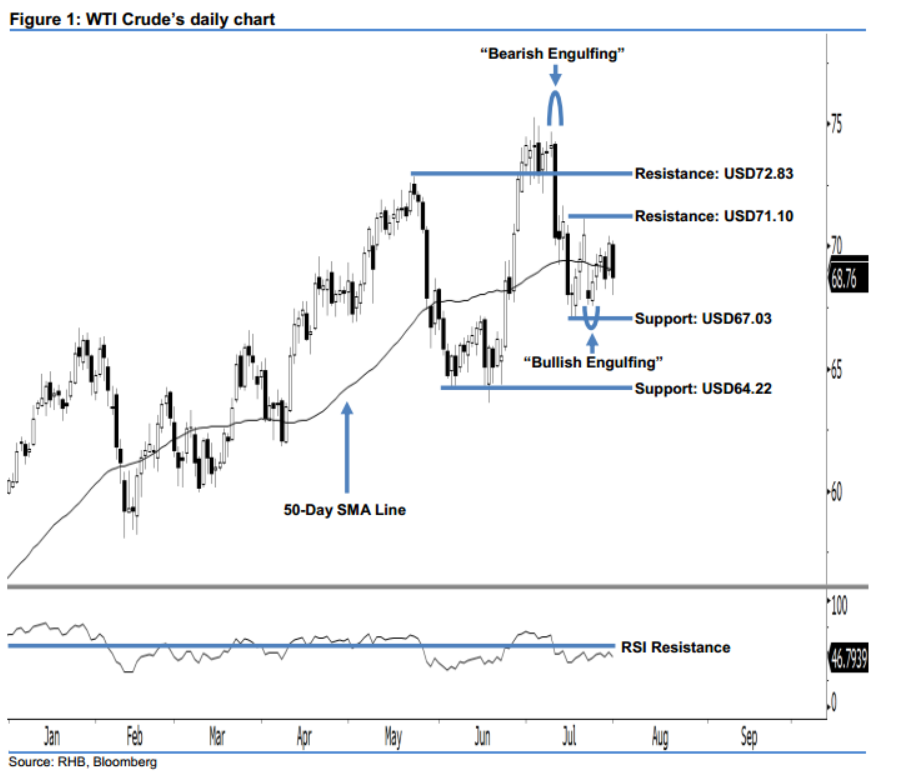

Keep in short positions as our bearish view remains in play. The WTI Crude ended at USD68.76 and posted a USD1.37 loss last night. It formed a black candle after oscillating between a low of USD67.98 and high of USD70.22. This shows that the session was led by the sellers. Presently, we do not see any strong positive follow-through of the momentum in the “Bullish Engulfing” candlestick pattern on 24 Jul. This implies that the bulls are still weak against the bears. Having said so, we believe that the bearish bias since the appearance of 11 Jul’s “Bearish Engulfing” candlestick pattern has not been fully negated. Overall, we make no change to our bearish view.

As long as we do not see a strong price movement above the USD71.10 resistance threshold, this indicates that market sentiment remains bearish. Thus, it is best that traders maintain short positions with a stop-loss set at above the aforementioned USD71.10. This is in order to minimise the upside risk. For the record, we initially made the short recommendation below USD72.83 on 12 Jul.

Our immediate support is maintained at USD67.03, which was the low of 17 Jul. The following support is found at USD64.22, located at the low of 5 Jun’s “Bullish Harami” pattern. Towards the upside, the immediate resistance is set at USD71.10, obtained from the high of 20 Jul. This is followed by the USD72.83 resistance mark, derived from the high of 22 May.

Source: RHB Securities Research - 1 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024