FKLI & FCPO: FKLI: Rebound Continues to Play Out

rhboskres

Publish date: Wed, 01 Aug 2018, 05:50 PM

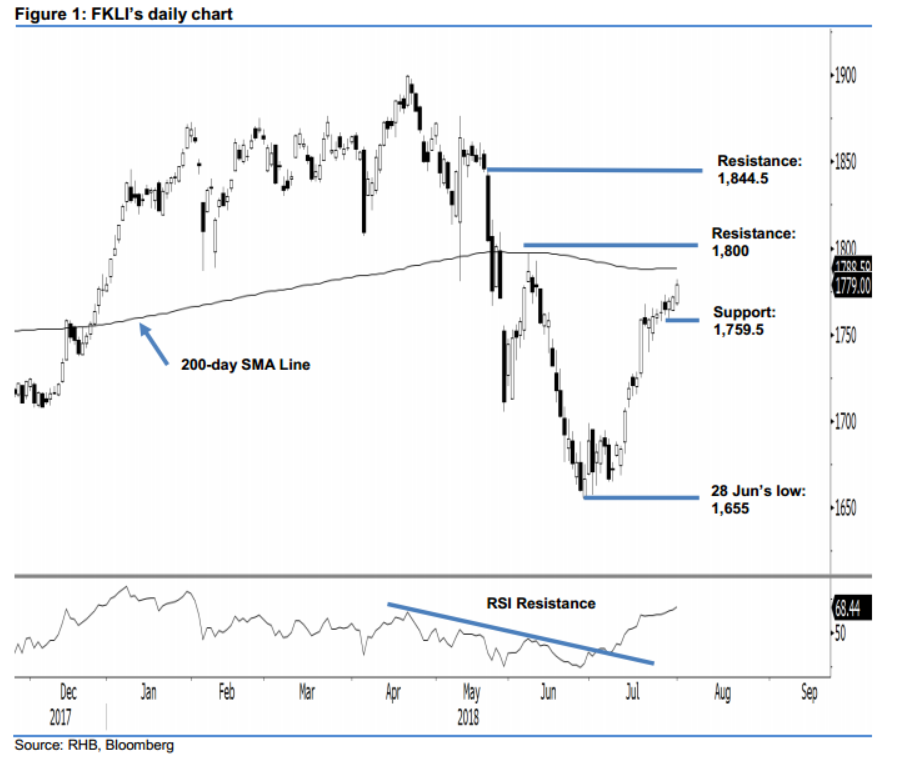

No signs of exhaustion to the rebound; maintain long positions. The FKLI had a positive performance in the latest session as it formed a white candle – the bulls managed to wrest control after a weak start. The session’s low and high were recorded at 1,766.5 pts and 1,782 pts, before closing 7 pts higher at 1,779 pts. The positive session continued to reinforce the bias that the rebound – in development since the low of 1,655 pts on 28 Jun –is still firmly intact and not showing signs of exhaustion. The latest closing level has placed the index close to test the 200-day SMA line, which currently stands at 1,788 pts. On this technical background, we maintain our near-term positive trading bias.

As the rebound continues to develop and move closer to test the 200-day SMA line, we advise traders to keep to long positions, initiated at 29 Jun’s close of 1,688.5 pts. To manage risks, we revise the trailing-stop to 1,759.5 pts.

We revise the immediate support to 1,759.5 pts, which is the low of 27 Jul. This is followed by 1,700 pts, the next round figure. Towards the upside, the immediate resistance is at 1,800 pts, near the high of 7 Jun. This is followed by 1,844.5 pts, the high of 23 May.

Source: RHB Securities Research - 1 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024