E-mini Dow Futures - Upside Move Resumes

rhboskres

Publish date: Mon, 06 Aug 2018, 09:33 AM

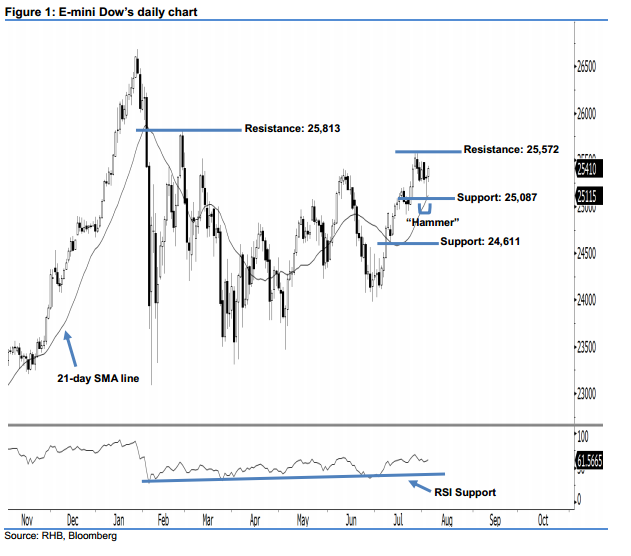

Stay long, with a new trailing-stop set below the 25,087-pt level. The E-mini Dow ended higher to form a white candle last Friday. It gained 105 pts to close at 25,410 pts, off its high of 25,437 pts and low of 25,260 pts. We believe the near-term upside move is likely to continue. This is as the index has recouped the previous session’s losses and marked a higher close above the rising 21-day SMA line. On a technical basis, last Friday’s white candle can be viewed as a continuation of the buyers extending the rebound from 2 Aug’s “Hammer” pattern. Overall, we keep our bullish view on the E-mini Dow’s near-term outlook.

Judging from the daily chart, the immediate support level is now seen at 25,087 pts, which was the low of 2 Aug’s “Hammer” pattern. The next support would likely be at 24,611 pts, determined from the low of 11 Jul. To the upside, we anticipate the immediate resistance level at 25,572 pts, ie the high of 27 Jul. If this level is taken out, look to 25,813 pts – obtained from the previous high of 27 Feb – as the next resistance.

To re-cap, on 11 Jul, we initially recommended traders to initiate long positions above the 24,600-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 25,087-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 6 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024