Hang Seng Index Futures - Weak Recovery

rhboskres

Publish date: Mon, 06 Aug 2018, 09:35 AM

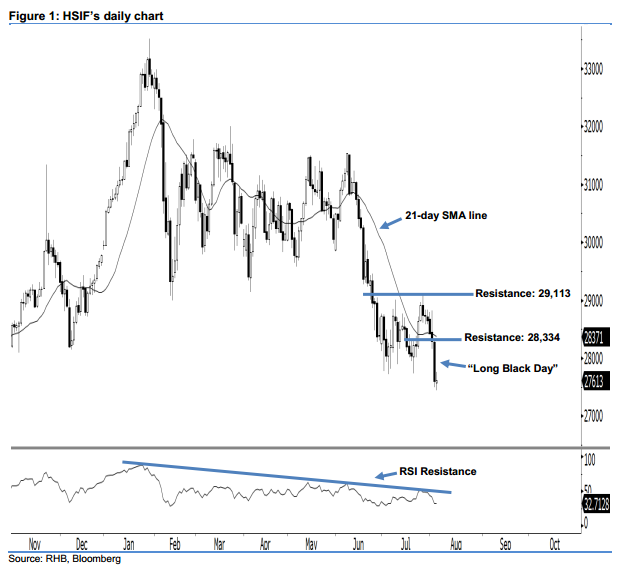

Maintain short positions. The HSIF ended on a “Doji” candle last Friday. It settled at 27,613 pts, after oscillating between a high of 27,758 pts and low of 27,444 pts. Still, the appearance of last Friday’s “Doji” candle merely indicates that sellers may be taking a pause following the recent plunge. In view that the 21-day SMA line is likely to begin turning downwards, this also implies a negative outlook sentiment. Overall, we believe the downside swing that started off 26 Jul’s black candle would likely continue in the coming sessions.

As seen in the chart, we anticipate the immediate resistance level at 28,334 pts, set at the high of 2 Aug’s “Long Black Day” candle. If a breakout occurs, the next resistance would likely be at 29,113 pts, ie the high of 26 Jul. Towards the downside, the near-term support level is seen at 27,244 pts, obtained from the previous low of 29 Sep 2017. This is followed by the 27,000-pt psychological spot.

Hence, we advise traders to maintain short positions, following our recommendation of initiating short below the 30,800-pt level on 18 Jun. A trailing-stop is preferably set above the 28,334-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 6 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024