WTI Crude Futures - Bearish Expectation Extends

rhboskres

Publish date: Mon, 06 Aug 2018, 09:53 AM

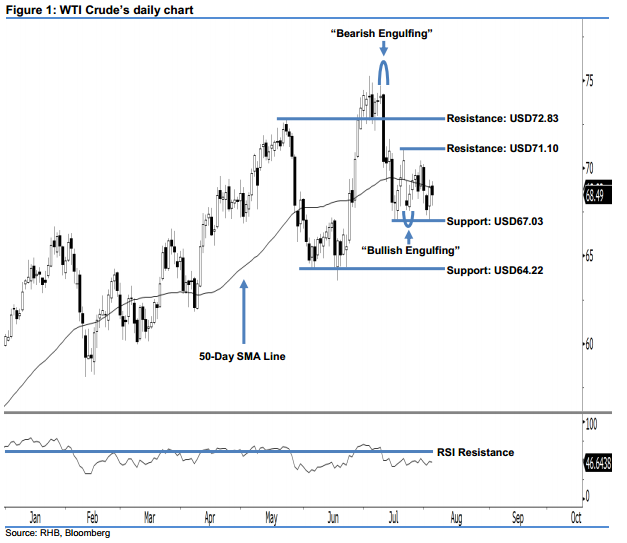

Keep to short positions in line with the ongoing bearish bias. Last Friday, the WTI Crude ended at USD68.49 pts, ie USD0.47 lower from its prior session. A black candle was formed after it hovered between a low of USD67.87 and high of USD69.24, which implies that session was led by the sellers. In line with the ongoing bearish bias, we see more opportunity towards the downside. We also highlight that the 14-day RSI indicator is situating below the 50-pt neutral level, at 46.64 pts. Technically speaking, the current bearish bias continues to exert itself, thereby enhancing our downside view.

The daily chart above shows that the sellers are in control of market sentiment. As such, it is best that traders maintain short positions with a stop-loss pegged above the USD71.10 mark. This is in order to minimise the upside risk. For the record, our short recommendation was originally initiated on 12 Jul, after the WTI Crude dropped below USD72.83.

Towards the downside, our immediate support is maintained at USD67.03, which was the low of 17 Jul. The next support is maintained at USD64.22, or the low of 5 Jun’s “Bullish Harami” pattern. On the flip side, our immediate resistance is pegged at USD71.10, or the high of 20 Jul. For the next resistance, look to the USD72.83 threshold, located at the high of 22 May.

Source: RHB Securities Research - 6 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024