FKLI & FCPO - FKLI: Bulls Still Resilient

rhboskres

Publish date: Tue, 07 Aug 2018, 09:38 AM

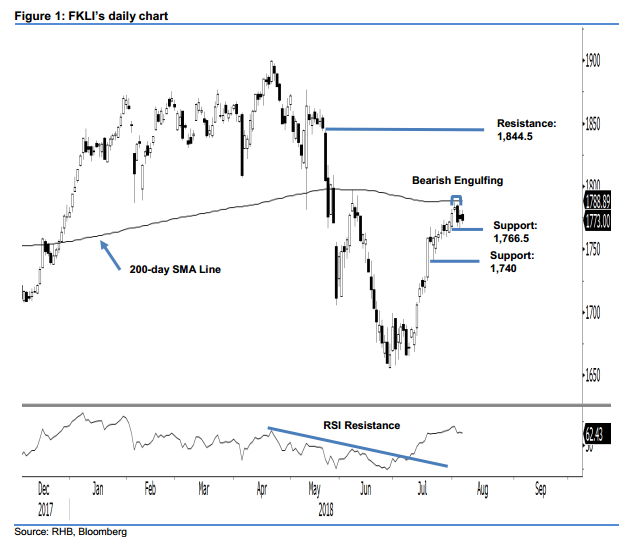

Bearish reversal pattern is still unconfirmed; maintain long positions. The FKLI closed neutrally yesterday, slipping just 1.5 pts to 1,773 pts. The session’s low and high were at 1,770 pts and 1,781 pts. The price actions of the index in the latest three sessions indicate that a consolidation phase is developing – which came after recent upward moves saw it tagging the 200-day SMA line on 1 Aug. Nevertheless, a deeper retracement may develop if the immediate support of 1,766.5 pts is breached – as this would confirm the “Bearish Harami” formation. Until that happens, we maintain our near-term positive trading bias.

The latest three sessions’ consolidation is still shallow and the “Bearish Engulfing” formation is still not confirmed yet. A confirmation, though, will mark the end of the rebound that began from the low of 1,655 pts on 28 Jun. We advise traders to keep to long positions, initiated at 29 Jun’s close of 1,688.5 pts. To manage risks, a trailing-stop can be set at 1,766.5 pts.

Immediate support is set at 1,766.5 pts, the low of 31 Jul. This is followed by 1,740 pts, the low of 20 Jul. On the other hand, the immediate resistance is at 1,800 pts, near the high of 7 Jun. This is followed by 1,844.5 pts, the high of 23 May.

Source: RHB Securities Research - 7 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024