WTI Crude Futures - a Dip Is Still Likely

rhboskres

Publish date: Tue, 07 Aug 2018, 09:39 AM

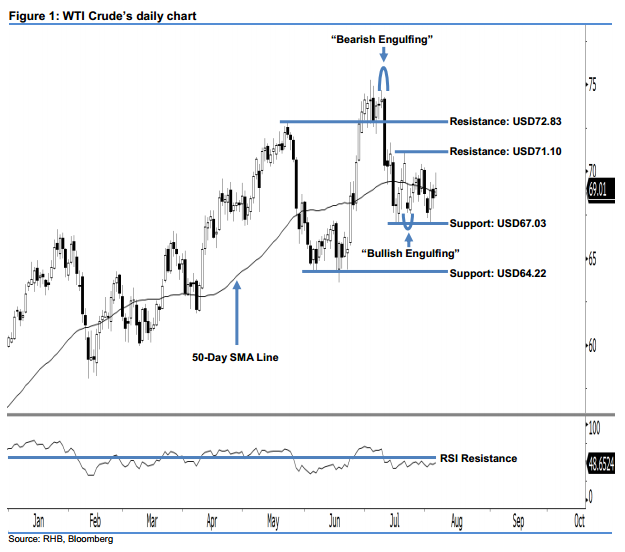

Best to stay in short positions as the correction is still intact. The WTI Crude posted a USD0.52 gain to close at USD69.01 last night. Nevertheless, this does not change our bearish view, as we do not see any strong upside movement yet. As a result, the momentum in the appearance of the “Bullish Engulfing” candlestick pattern on 24 Jul remains unconfirmed. Based on the current technical landscape, the correction could still be extended once the breather above USD67.03 ends. Our bearish bias is also supported by the fact that the 14-day RSI indicator is fluctuating below 50 pts at 48.65 pts – an indication that market sentiment is weak.

As we believe more opportunities are leaning towards the sellers, traders are advised to stay in short positions. For the risk-minimisation purposes, traders are advised to set a stop-loss above the USD71.10 mark. Our short recommendation was initially triggered on 12 Jul, after strong selling activity led the WTI Crude’s price to close below USD72.83.

We set the immediate support at USD67.03, or the low of 17 Jul. In the event that this level is taken out, the following support is at USD64.22, the low of 5 Jun’s “Bullish Harami” pattern. Meanwhile, our immediate resistance is maintained at USD71.10, ie the high of 20 Jul. This is followed by the next resistance at USD72.83, the high of 22 May.

Source: RHB Securities Research - 7 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024