FKLI & FCPO - FKLI: Rebound Is Extending

rhboskres

Publish date: Wed, 08 Aug 2018, 05:07 PM

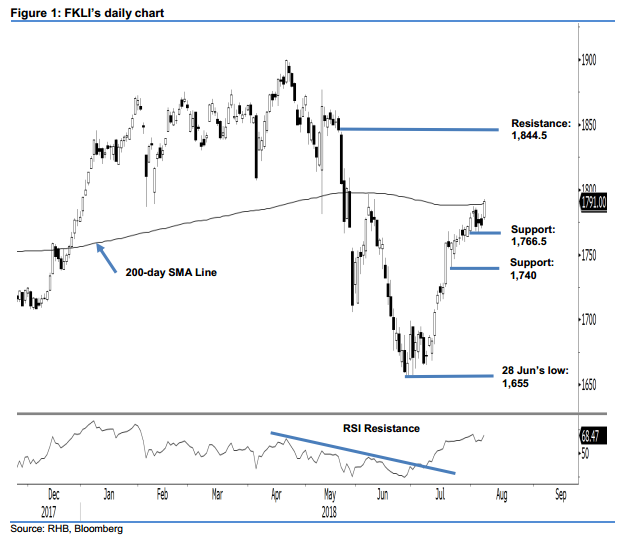

Bearish reversal formation invalidated; maintain long positions. The FKLI’s latest session was under the bulls’ control, as it formed a white candle, which at the closing, slightly breached above the 200-day SMA line (current reading: 1,789 pts). The positive closing also invalidated the “Bearish Harami” formation that appeared on 2 Aug. The session’s low and high were recorded at 1,776.5 pts and 1,792.5 pts respectively, before ending at 1,791 pts, implying a gain of 18 pts. The invalidation of the “Bearish Harami” formation is indicative that the index’s rebound – since the low of 1,655 pts on 28 Jun – is still firmly intact and still not showing any signs of exhaustion. Hence, we maintain our near-term positive trading bias.

As the rebound continues to extend, with the index is closing slightly above the 200-day SMA line – this suggests a still positive bias. We therefore advise traders to keep to long positions, initiated at 29 Jun’s close of 1,688.5 pts. To manage risks, a trailing-stop can be set at 1,766.5 pts.

Towards the downside, the immediate support is expected at 1,766.5 pts, the low of 31 Jul. The following support is at 1,740 pts, the low of 20 Jul. Towards the upside, the immediate resistance is at 1,800 pts, near the high of 7 Jun. This is followed by 1,844.5 pts, the high of 23 May.

Source: RHB Securities Research - 8 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024