FKLI & FCPO - FKLI: First Sign of Weakness Emerges

rhboskres

Publish date: Fri, 03 Aug 2018, 06:21 PM

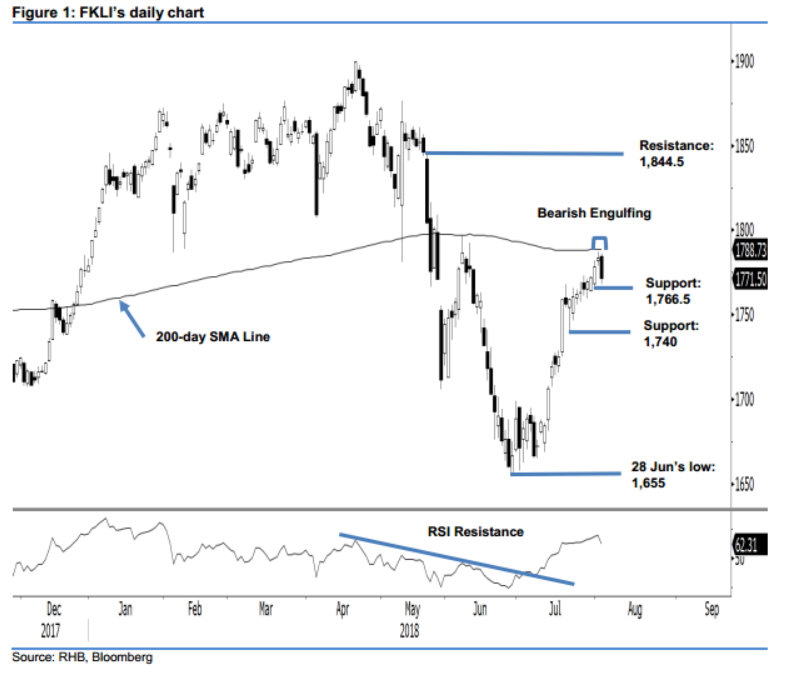

Maintain long positions, pending the confirmation of the “Bearish Engulfing” pattern. The FKLI marked a bearish session in its latest trading, forming a black candle that covered the body of the previous white candle – thus forming a “Bearish Engulfing” pattern. The index generally trended lower throughout the session – low and high were recorded at 1,768 pts and 1,786 pts, before closing 12 pts weaker at 1,771.5 pts. The said bearish formation is notable, as it came after the index came close to test the 200-day SMA line in the prior session – this implies a price rejection at the SMA line. For confirmation of the bearish formation, a downside break of the immediate support of 1,766.5 pts is required. Until that happens, we are keeping our near-term positive trading bias.

Pending for the confirmation of the “Bearish Engulfing” formation, which if happens, could mark the end of the rebound since the low of 1,655 pts on 28 Jun. We therefore advise traders to keep to long positions, initiated at 29 Jun’s close of 1,688.5 pts. To manage risks, a trailing-stop can be set at 1,766.5 pts.

The immediate support is set at 1,766.5 pts, the low of 31 Jul. The following support is at 1,740 pts, the low of 20 Jul. On the other hand, the immediate resistance is at 1,800 pts, near the high of 7 Jun. This is followed by 1,844.5 pts, the high of 23 May.

Source: RHB Securities Research - 3 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024