Hang Seng Index Futures - Stick to Short Positions

rhboskres

Publish date: Thu, 09 Aug 2018, 09:51 AM

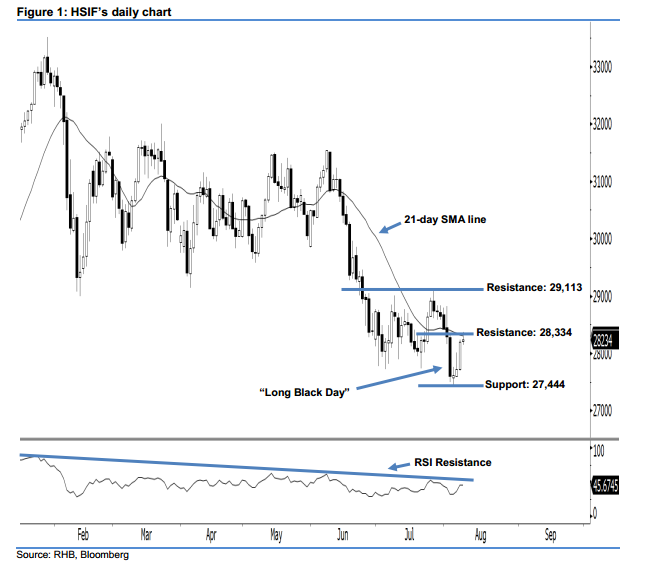

Maintain short positions with a trailing-stop set above the 28,334-pt resistance. The HSIF formed a “Doji” candle yesterday. It settled at 28,234 pts, after oscillating between a high of 28,374 pts and low of 28,142 pts. Based on the current outlook, the index has failed to close above the 21-day SMA line and the 28,334-pt resistance mentioned previously, which implies that sellers are still in control of the market. As the 21-day SMA line is likely to begin turning downwards, this would also enhance the downward momentum. Overall, we keep our bearish view on the HSIF’s near-term outlook.

As seen in the chart, the immediate resistance is seen at 28,334 pts, which was the high of 2 Aug’s “Long Black Day” candle. If this level is taken out, look to 29,113 pts – ie the previous high of 26 Jul – as the next resistance. On the other hand, we maintain the immediate support at 27,444 pts, defined from the low of 3 Aug. The next support is anticipated at 27,244 pts, ie the previous low of 29 Sep 2017.

Therefore, we advise traders to stay short, in line with our initial recommendation to have short positions below the 30,800-pt level on 18 Jun. A trailing-stop can be set above the 28,334-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 9 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024