COMEX Gold - Short Call Stays Intact

rhboskres

Publish date: Thu, 09 Aug 2018, 09:52 AM

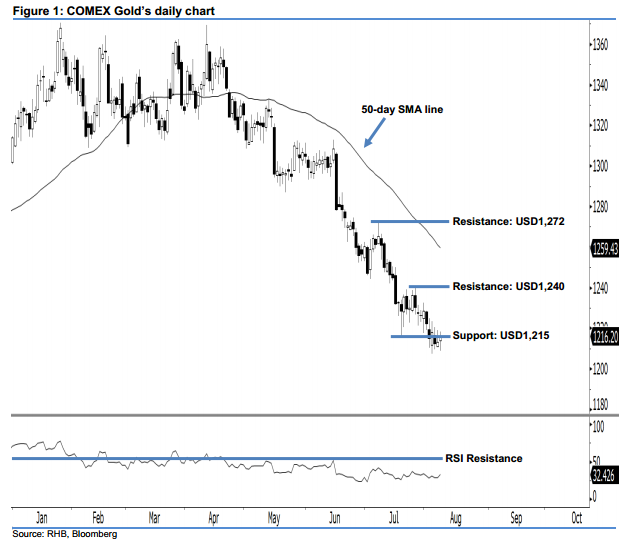

Traders are advised to stay short, in line with the ongoing downtrend. The COMEX Gold inched up USD2.90 to USD1,216.20 last night. This increase led the commodity to breach slightly above the previous USD1,215 resistance. However, we maintain our bearish view, given that no strong upside development has been sighted yet. At this juncture, the bears are still dominating market sentiment. In addition, the fact that the 14- day RSI indicator is situated below the 50-pt neutral level – at 32.43 pts – points towards a weak outlook. This enhances our downside view.

Looking at the daily chart, we believe the downtrend is still in play. As such, we reiterate our short recommendation with a trailing-stop pegged above the USD1,240 threshold. This is in order to secure part of the trading profits. For the record, we made the short recommendation on 16 May following a firm downside development below the USD1,309 level.

We set the immediate support at USD1,215, which was the low of 20 Jul’s Bullish Engulfing” pattern. In the event this level is taken out, the next support is set at USD1,207 – this is located at the low of 10 Jul 2017. On the flip side, our immediate resistance is pegged at USD1,240, or near the high of 26 Jul. For the next resistance, look to USD1,272, ie 9 Jul’s high.

Source: RHB Securities Research - 9 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024