COMEX Gold - the Ongoing Bearish Sentiment

rhboskres

Publish date: Wed, 15 Aug 2018, 05:26 PM

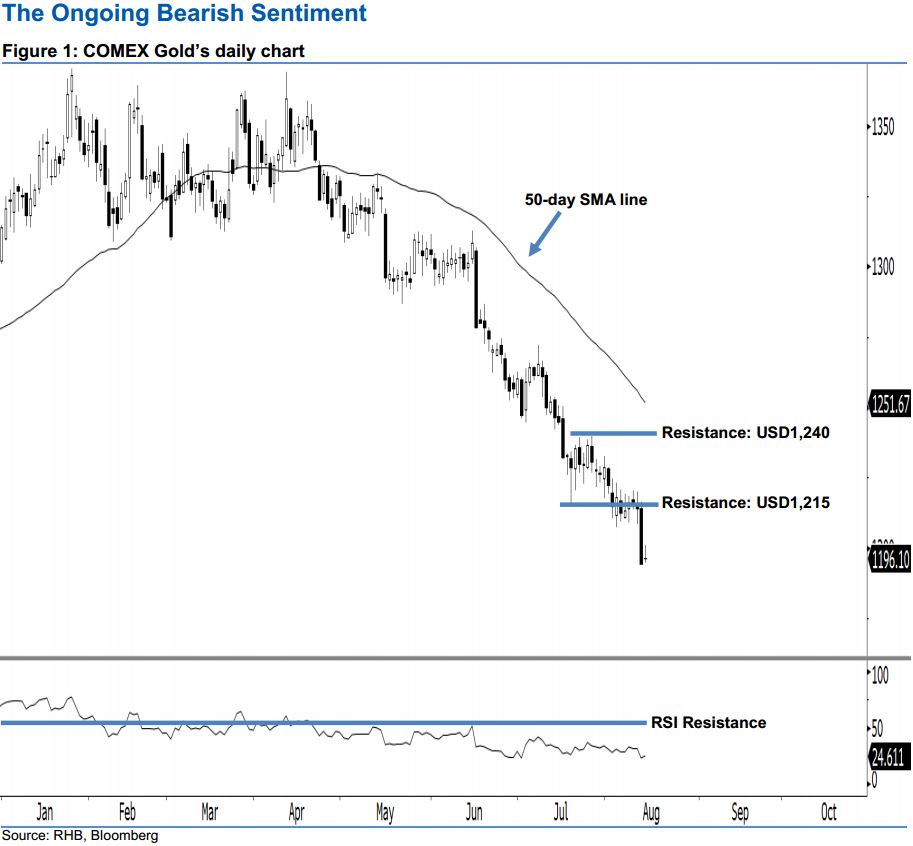

Traders are advised to stay short, as the downtrend remains intact. After the COMEX Gold dropped to its fresh low since 2017 on 13 Jul, the commodity rebounded by USD1.90 to USD1,196.10 last night. Nevertheless, this does not change our 4-month bearish view, as we do not see any strong upside development yet. From our technical perspective, the increase is viewed as the COMEX Gold merely taking a breather. This is a normal reaction, especially after we saw an oversold situation in the prior session, where the 14-day RSI indicator was below the 30-pt level at 22.43 pts.

As the downtrend is still firmly in play, this implies more potential downside movements ahead. Hence, traders are advised to stay in short positions. In order to lock in part of the trading profits, we recommend setting a trailingstop above the USD1,240 level. For the record, our short call was made on 16 May, following a firm breach below the USD1,309 threshold.

Our immediate support is maintained at USD1,182, ie near the low of 27 Jan 2017. This is followed by the next support at the USD1,158 mark, which was 12 May 2017’s low. Towards the upside, we keep the immediate resistance at USD1,215, or the low of 20 Jul’s Bullish Engulfing” pattern. The next resistance is pegged at the USD1,240 threshold, ie near the high of 26 Jul.

Source: RHB Securities Research - 15 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024