FKLI - Correction Is Developing

rhboskres

Publish date: Wed, 15 Aug 2018, 05:28 PM

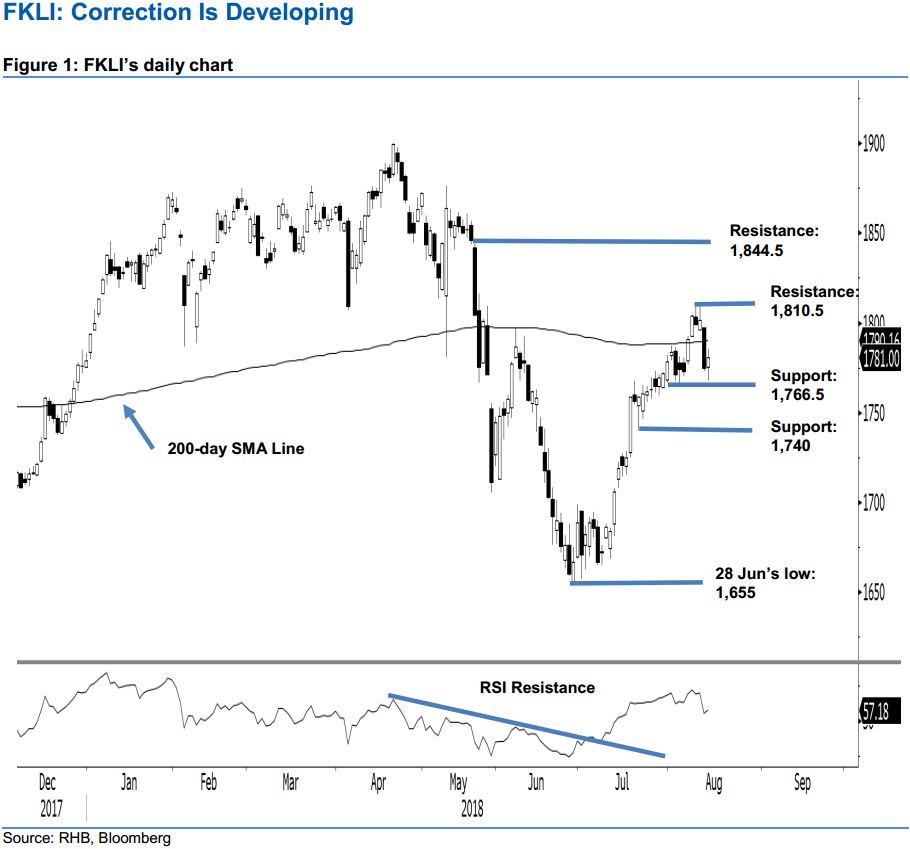

Maintain short positions as the bias is still bearish. The FKLI’s latest performance can be seen as positive as it managed to register a gain of 6 pts to close at 1,781 pts. During the session, it came close to testing the immediate support with a low of 1,768 pts, before it rebounded and reached a high of 1,785.5 pts. On the broader picture, we maintain that the index is still in the early part of an on-going correction phase – probably in the form of a retracement. This correction phase is triggered after the index experienced a relatively steep rally in recent weeks. On this, we maintain our near-term negative trading bias on the index.

With the negative bias still intact and as the index is still capped by the 200-day SMA line (current reading: 1,790 pts), we continue to advise traders to keep to short positions. We initiated these positions at 1,775 pts, the closing level of 13 Aug. For risk management purposes, a stop-loss can be set above 1,810.5 pts.

Immediate support may emerge at 1,766.5 pts, the low of 31 Jul. The following support is at 1,740 pts, the low of 20 Jul. On the other hand, the immediate resistance is set at 1,810.5 pts, the highs of 9 and 10 Aug. This is followed by 1,844.5 pts, the high of 23 May

Source: RHB Securities Research - 15 Aug 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024