RHB Retail Research

Technical Analysis - British American Tobacco

rhboskres

Publish date: Wed, 10 Oct 2018, 04:33 PM

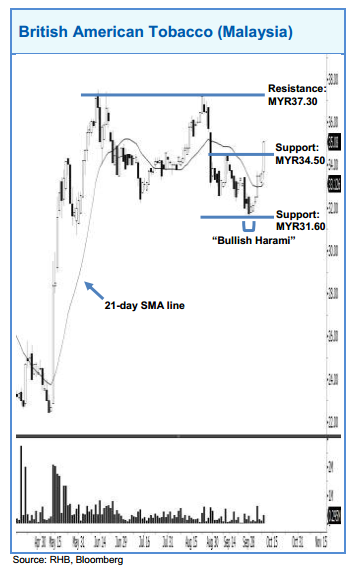

British American Tobacco’s upward momentum may persist after the stock continued holding above the 21-day SMA line lately. Yesterday’s candle can be viewed as a continuation of the bulls extending the rebound from 1 Oct’s “Bullish Harami” pattern. A bullish bias may appear above the MYR34.50 level, with an exit set below the MYR31.60 threshold. Towards the upside, the near-term resistance is at MYR37.30. This is followed by the MYR40.00 level.

Source: RHB Securities Research - 10 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments