FCPO - Taking a Pause

rhboskres

Publish date: Tue, 08 Jan 2019, 10:29 AM

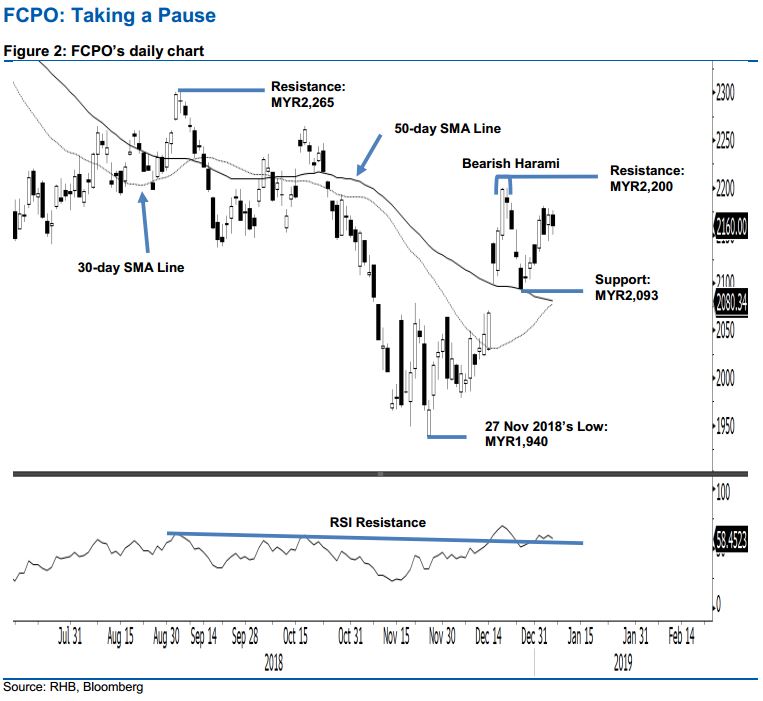

Maintain long positions to ride on rebound extension. The FCPO ended the latest session on a softer note, it eased MYR12 to settle at MYR2,160. The commodity generally moved lower for the entire session, the low and high were at MYR2,150 and MYR2,176. The FCPO’s latest three sessions’ performance suggests it is in the process of developing a minor consolidation phase after the recent rally from the 50-day SMA line level. Once this consolidation phase is completed, chances are high that it would extend its upward move, which started from the low of MYR1,940 on 27 Nov 2018. As such, we are maintaining our positive trading bias.

As there are no severe price actions to signal the commodity’s upward move has reached an end, we continue to recommend that traders keep to long positions, which we initiated at MYR2,172 ie the closing level of 4 Jan. For risk management purposes, a stop-loss can be placed at MYR2,093.

The immediate support is pegged at MYR2,093, the low of 26 Dec 2018. This is followed by MYR2,000. Moving up, the immediate resistance is expected at MYR2,200, the high of the 20 Dec. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 8 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024