COMEX Gold - No Clear Signs for Retracement

rhboskres

Publish date: Wed, 09 Jan 2019, 05:32 PM

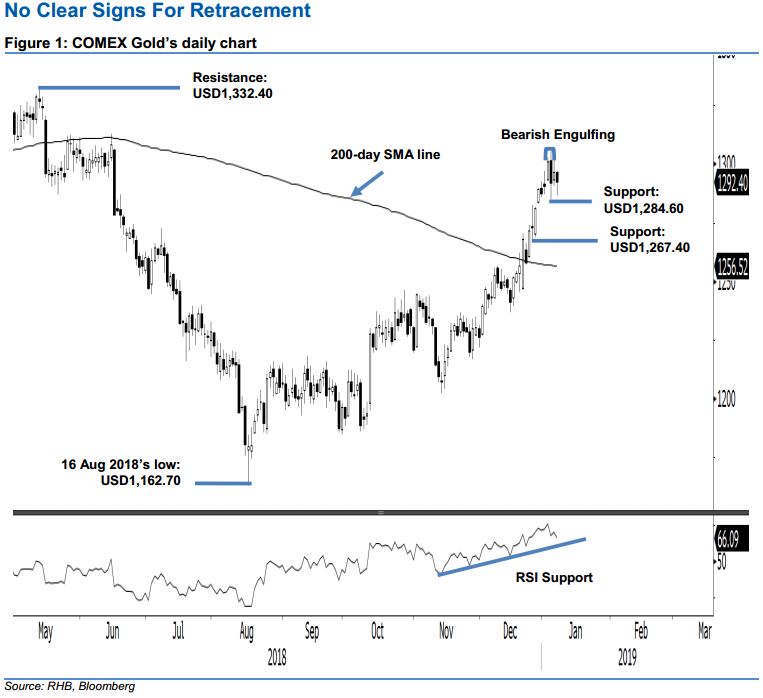

Maintain long positions, as there are no clear signs of a deeper price retracement developing. In the latest session, the COMEX Gold eased USD4 to close at USD1,292.40. This was after it failed to sustain the earlier session’s positive momentum. The high and the low were posted at USD1,297.20 and USD1,286.70. Even so, there was still no price confirmation to the “Bearish Engulfing” formation that appeared on 4 Jan. This implies that the risk for the commodity to develop a deeper retracement or total price reversal remains low. For said bearish formation be confirmed, a downside breach of the immediate support is required. Taking this into consideration, we keep our positive trading bias.

As the daily chart continues to suggest that the COMEX Gold’s upward price trajectory still looks positive, we still recommend traders to keep long positions, which we initiated at the USD1,216 mark. This was 14 Nov 2018’s closing level. For risk-management purposes, a stop-loss can be placed below the USD1,284.60 threshold.

The immediate support is expected at USD1,284.60, ie the latest session’s low. The following support is at USD1,267.40, or the low of 21 Dec 2018. Conversely, the immediate resistance is pegged at USD1,332.40, which was the high of 11 May 2018. This is followed by USD1,370.50, or the high of 25 Jan 2018.

Source: RHB Securities Research - 9 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024