FCPO - Upward Move May Still Be Extending

rhboskres

Publish date: Wed, 09 Jan 2019, 05:37 PM

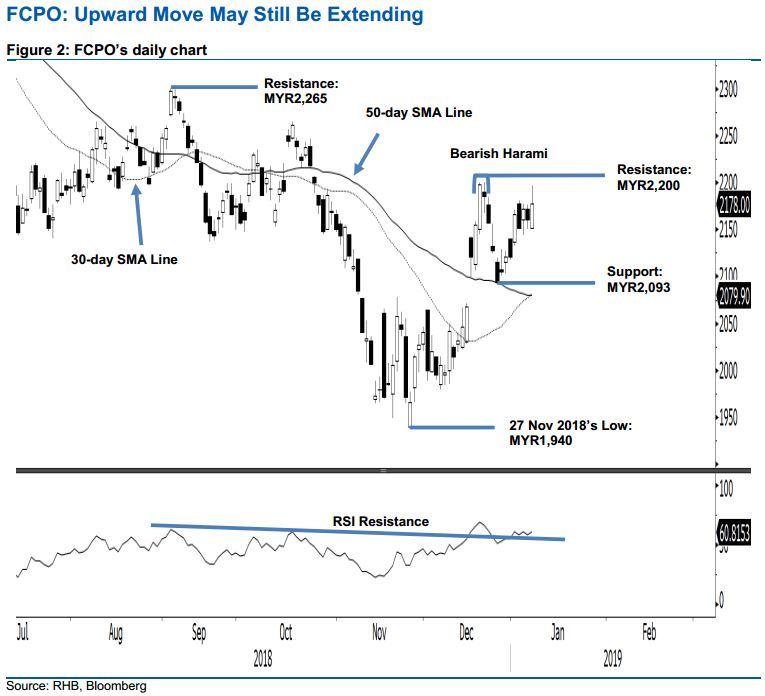

Bulls are still showing control; maintain long positions. The FCPO formed a white candle in the latest session and at one point, came near to test the immediate resistance of MYR2,200. The low and high were registered at MYR2,151 and MYR2,197, before it ended MYR18 higher at MYR2,178. The positive session means the commodity’s upward move that started from the low of MRY1,940 on 27 Nov 2018 is continuing to develop. Lending further support to this bias is the daily RSI that has now crossed above the resistance line, indicating a positive momentum. Hence, we are maintaining our positive trading bias.

As the commodity is showing signs of extending its positive price trajectory, we continue to recommend that traders keep to long positions, which we initiated at MYR2,172 ie the closing level of 4 Jan. For risk management purposes, a stop-loss can be placed at MYR2,093.

Towards the downside, the immediate support is eyed at MYR2,093, the low of 26 Dec 2018. The following support is at MYR2,000. Conversely, the immediate resistance is expected at MYR2,200, the high of the 20 Dec. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 9 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024