FCPO - Testing Immediate Resistance

rhboskres

Publish date: Thu, 10 Jan 2019, 05:38 PM

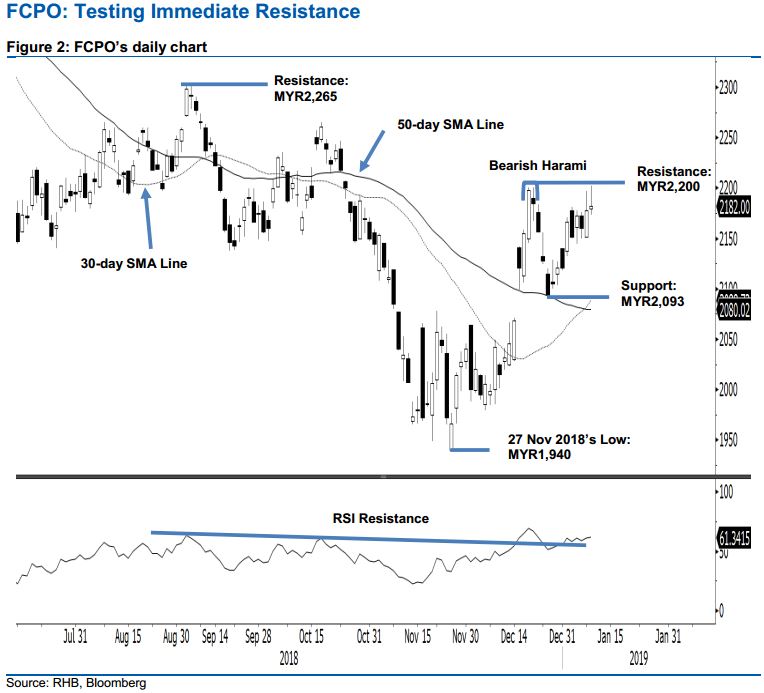

Maintain long positions as the positive momentum is still in place. The FCPO tested the immediate resistance of MYR2,200 yesterday. The session’s high and low were at MYR2,202 and MYR2,173, before the commodity closed slightly higher at MYR2,182, indicating a MYR4 gain. The attempt to break above the immediate resistance can be viewed as the bulls keeping their firm control over the multi-week uptrend. This positive bias could be further enhanced if the resistance mark is breached in upcoming sessions. The daily RSI reading of 61.3 also suggests the upward move so far is not stretched yet. As such, we hold on to our positive trading bias.

As price trend remains positive, we continue to recommend that traders keep to long positions, which we initiated at MYR2,172 the closing level of 4 Jan. For risk management purposes, a stop-loss can be placed at MYR2,093.

Immediate support is set at MYR2,093, the low of 26 Dec 2018. The second support is at MYR2,000. Meanwhile, we are keeping the immediate resistance at MYR2,200, the high of the 20 Dec. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 10 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024