E-mini Dow Futures - Fifth Consecutive Positive Candle

rhboskres

Publish date: Fri, 11 Jan 2019, 05:09 PM

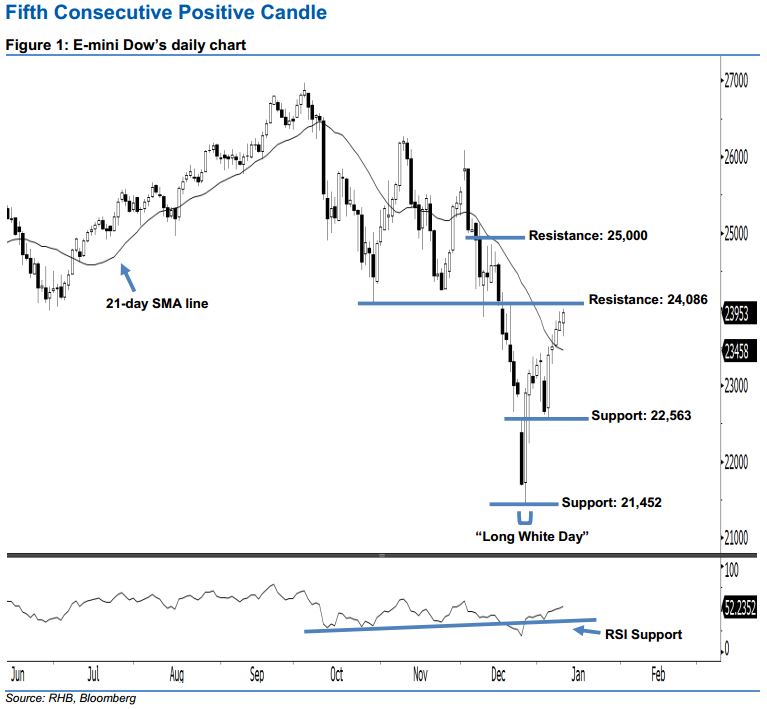

Upside move is likely to continue; stay long. The buying momentum in the E-mini Dow continued as expected. Another white candle was formed last night, which pointed towards a continuation of the upside move. It rose 123 pts to close at 23,953 pts, off its high of 23,999 pts and low of 23,640 pts. From a technical perspective, we expect the upside swing from 26 Dec 2018’s “Long White Day” candle to go on. This is because the E-mini Dow has posted a fifth consecutive positive candle and marked a higher close above the 21-day SMA line – implying the market sentiment is bullish. Overall, we maintain our bullish outlook.

As seen in the chart, we are eyeing the immediate support level at 22,563 pts, ie the low of 4 Jan. If this level is taken out, look to 21,452 pts – which was the low of 26 Dec 2018’s “Long White Day” candle – as the next support. On the other hand, we maintain the immediate resistance level at 24,086 pts, obtained near the high of 19 Dec 2018. Meanwhile, the next resistance is seen at the 25,000-pt psychological spot.

Hence, we advise traders to stay long, following our recommendation of initiating long above the 22,400-pt level on 27 Dec 2018. A trailing-stop is preferably set below the 22,563-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 11 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024