WTI Crude Futures: Bulls Are Taking a Pause

rhboskres

Publish date: Tue, 15 Jan 2019, 10:25 AM

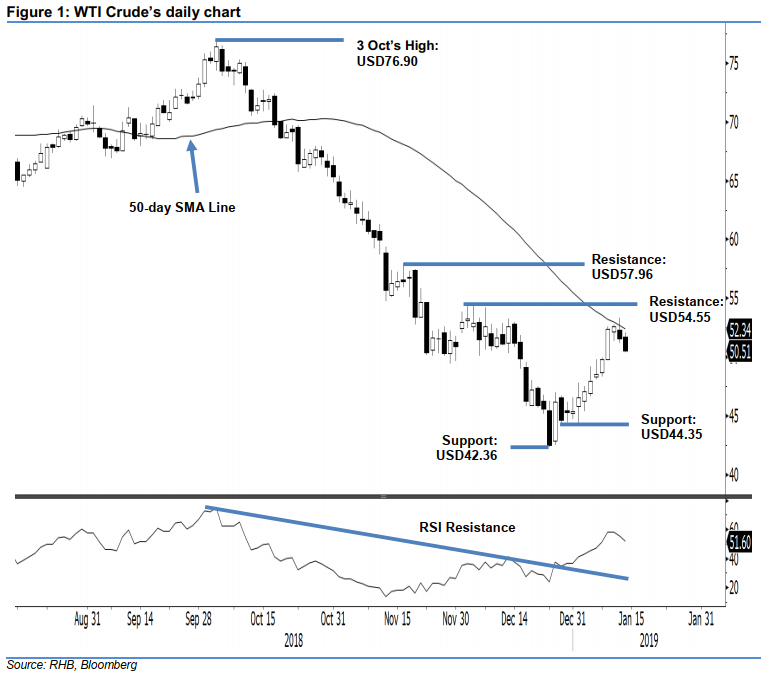

Maintain long positions as the commodity is consolidating below the 50-day SMA line. The WTI Crude formed a black candle in the latest session. At the closing it weakened USD1.08 to settle at USD50.51. Intraday low and high were posted at USD50.40 and USD52.10. The black gold’s price actions in the recent two sessions near the 50-day SMA line are suggesting a possible consolidation is developing – after it experienced a sharp rally recently. Provided the recent low of USD42.36 is not breached to the downside, chances are high that the said rebound phase could still be extended. As such, we maintain our positive trading bias.

We continue to expect the ongoing upward move – which itself is a technical rebound for the steep decline of between early-Oct 2018 and end-Dec 2018 – to extend. As such, we continue to recommend traders keep to long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stoploss can be placed below the USD42.36 level.

Immediate support is still expected to emerge at USD44.35, which was the low of 2 Jan. The second support is at the USD42.36 mark, or the low of 24 Dec 2018. Meanwhile, immediate resistance is set at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024