WTI Crude Futures - Testing 50-Day SMA Line Again

rhboskres

Publish date: Wed, 16 Jan 2019, 09:27 AM

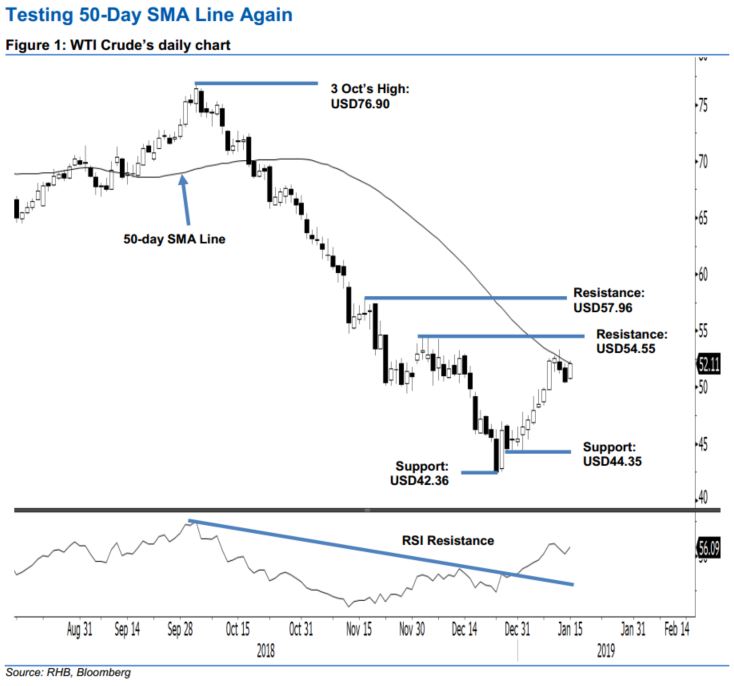

Maintain long positions to ride on technical rebound. The WTI Crude formed a white candle in the latest session and came near to test the 50-day SMA line. Intraday tone was encouraging as the price generally moved higher, with the low and high registered at USD50.64 and USD52.30, before closing at USD52.11, indicating a gain of USD1.60. Towards the upside, the commodity needs to overcome the 50-day SMA line to signal the possibility of extending its rebound that started from the low of USD42.36 on 24 Dec 2018. The daily RSI reading of 56.09 is also showing that the rebound has not reached an overbought territory yet. Based on these observations, we are keeping our positive trading tone.

As we believe chances are still high for the technical rebound that started from the 24 Dec 2018’s low to extend, we continue to recommend traders to keep to long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stop-loss can be placed below the USD42.36 level.

We are pegging the immediate support at USD44.35, which was the low of 2 Jan. This is followed by the USD42.36 mark, or the low of 24 Dec 2018. Towards the upside, immediate resistance is set at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 16 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024