Hang Seng Index Futures - the Upside Swing Resumes

rhboskres

Publish date: Wed, 16 Jan 2019, 09:29 AM

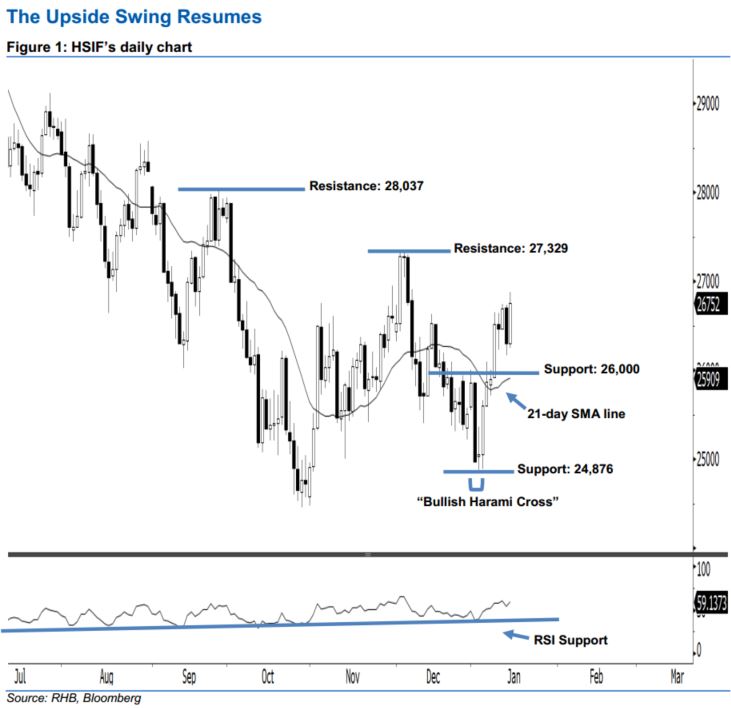

The upside move is likely to continue – stay long. The HSIF ended higher to form a white candle yesterday. It rose to a high of 26,874 pts during the intraday session before ending at 26,752 pts for the day. From a technical viewpoint, market sentiment remains bullish. This is because the index has recouped the previous day’s losses and closed above the previously-indicated 26,746-pt resistance. This may also further extend the rebound that started with 3 Jan’s “Bullish Harami Cross” pattern. Overall, we remain bullish on the HSIF’s outlook.

Based on the daily chart, we anticipate the immediate support at the 26,000-pt psychological spot. If a breakdown arises, the crucial support is maintained at 24,876 pts, which was determined from the low of 3 Jan’s “Bullish Harami Cross” pattern. To the upside, we are now eyeing the resistance at 27,329 pts, ie the high of 4 Dec 2018. This is followed by 28,037 pts, which was obtained from the previous high of 26 Sep 2018.

As a result, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 26,000-pt level on 10 Jan. A stop-loss set below the 24,876-pt threshold is advisable in order to limit the downside risk.

Source: RHB Securities Research - 16 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024