COMEX Gold - Sideway Consolidation

rhboskres

Publish date: Fri, 18 Jan 2019, 04:53 PM

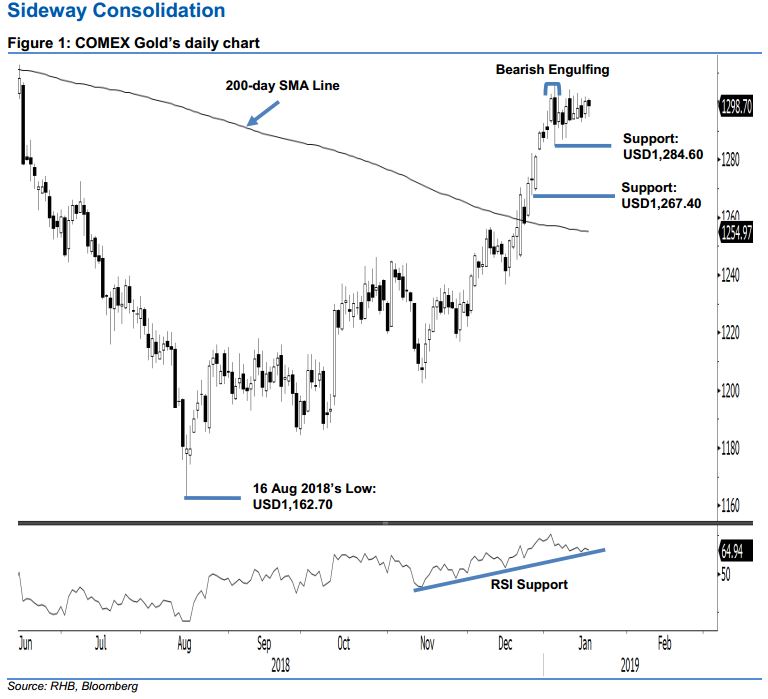

Maintain long positions as the price pattern is suggesting a sideway consolidation. There was not much price action during the latest trading session. It settled USD1.90 lower at USD1,298.70, after it swung between a low and high of USD1,294.80 and USD1,301.30. Looking at the price action since the appearance of the “Bearish Engulfing” formation on 4 Jan, the commodity appears to be developing a narrow sideway consolidation – this implies that the bulls are merely taking a breather after a multi-week sharp upward move. Towards the downside, a breach of the immediate support could raise the risk of a sharper retracement – as it would confirm the “Bearish Engulfing” formation. Hence, we keep to our positive trading bias.

With the commodity still showing healthy signs of a narrow sideway consolidation for now, we continue to recommend traders to keep to long positions – we initiated this at the USD1,216 mark, which was 14 Nov 2018’s closing level. For risk-management purposes, a stop-loss can be placed below the USD1,284.60 threshold.

Immediate support is set at USD1,284.60, ie the latest session’s low. This is to be followed by USD1,267.40, or the low of 21 Dec 2018. Meanwhile, overhead resistance is tagged at USD1,332.40, which was the high of 11 May 2018. This is followed by USD1,370.50, or the high of 25 Jan 2018.

Source: RHB Securities Research - 18 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024