WTI Crude Futures - Hovering Near 50-Day SMA

rhboskres

Publish date: Fri, 18 Jan 2019, 04:54 PM

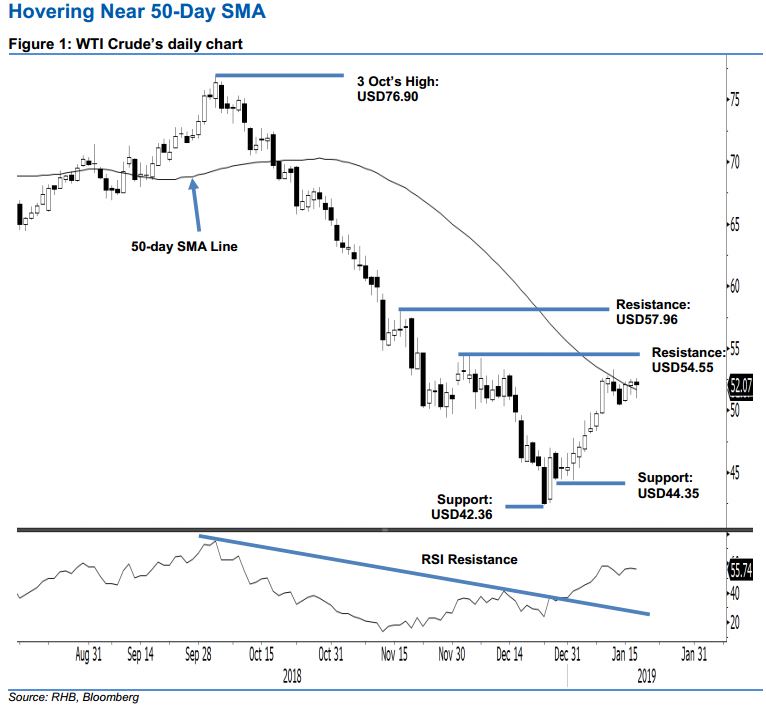

Maintain long positions. The black gold ended the latest trading session slightly lower by USD0.24 to close at USD52.07 – this was after it ranged between USD50.98 and USD52.58. The commodity has been consolidating around the 50-day SMA line over the past five sessions – after its prior 2-week sharp rally, suggesting that the bulls are taking a breather for now. Towards the upside, a firm breakout from this SMA would extend the rebound further. Meanwhile, the daily RSI reading of 55.74 is also suggesting headroom for further upward move. On these technicalities, we are keeping our positive trading tone.

As there are no signs suggesting that the rebound which started from 24 Dec 2018’s low has exhausted, we continue to recommend traders to keep to long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stop-loss can be placed below the USD42.36 level.

Towards the downside, immediate support is expected at USD44.35, which was the low of 2 Jan. The second support is at the USD42.36 mark, or the low of 24 Dec 2018. Moving up, immediate resistance is set at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 18 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024