COMEX Gold - Nearing the Low of the Sideways Move

rhboskres

Publish date: Tue, 22 Jan 2019, 08:58 AM

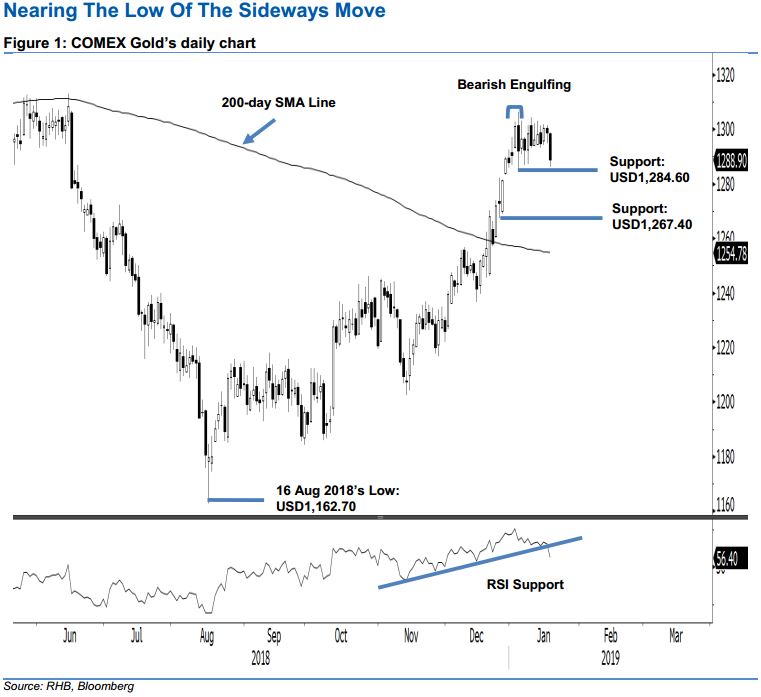

Still confined within the sideways consolidation pattern; maintain long positions. The precious metal formed a black candle in the latest trading session to close not too far away from the immediate support of USD1,284.60. The intraday tone was negative as it moved relatively sharply lower for the entire session – the high and low were posted at USD1,298.60 and USD1,286.30, before ending at USD1,288.90, indicating a decline of USD9.80. Looking at the price pattern developed since the appearance of the “Bearish Engulfing” on 4 Jan, the commodity is still trading in the relatively narrow sideways consolidation mode. Risk for greater retracement would only likely emerge if the said immediate support – which is also the lower bound of the sideway consolidation, is broken. Until this happens, we keep to our positive trading bias.

As the commodity is still fluctuating within the sideways consolidation zone, we continue to recommend traders to keep to long positions – we initiated this at the USD1,216 mark, which was 14 Nov 2018’s closing level. For riskmanagement purposes, a stop-loss can be placed below the USD1,284.60 threshold.

Immediate support is maintained at USD1,284.60, ie the latest session’s low. The second support is at USD1,267.40, or the low of 21 Dec 2018. Conversely, immediate resistance is expected at USD1,332.40, which was the high of 11 May 2018. This is followed by USD1,370.50, or the high of 25 Jan 2018.

Source: RHB Securities Research - 22 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024