FCPO - Bulls Charging Ahead

rhboskres

Publish date: Tue, 22 Jan 2019, 09:15 AM

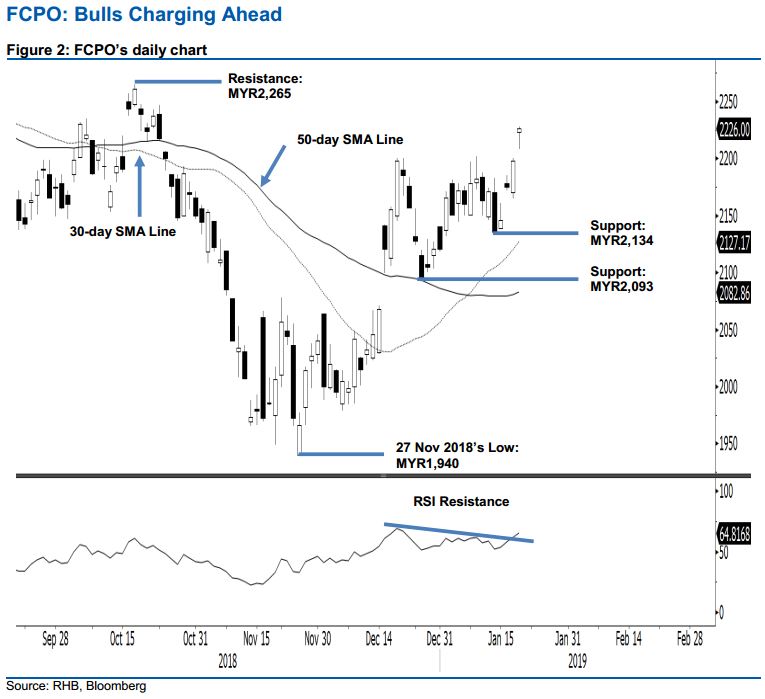

Initiate long positions as the consolidation finished earlier than expected. The FCPO formed a white candle and leaving an “Upside Gap” in the latest trading, which at the closing, breached above the previous immediate resistance of MYR2,202. The session’s low and high were recorded at MYR2,208 and MYR2,228, before it ended MYR28 higher at MYR2,226. The breach of the said previous immediate resistance suggests that the commodity’s previous consolidation phase, which was narrower than our expectations, has ended. To recap, we had expected it to retest the MYR2,093 support mark. Overall, the latest positive session indicates the commodity’s upward move from the low of MYR1,940 on 27 Nov is continuing to develop. Hence, we switch our trading bias to positive.

Our previous short positions initiated at MYR2,136 on 14 Jan were closed out at the latest session at MYR2,202. With the upward move showing signs of resuming, we initiate long positions at the latest close. For risk management purposes, a stop-loss can be placed below MYR2,134.

The immediate support is revised to MY2,134, which was the low of 14 Jan This is followed by MYR2,093, the low of 26 Dec 2018. Conversely, the immediate resistance is now pegged at MYR2,265, the high of 17 Oct. This is followed by MY2,303, the high of 5 Sep 2018.

Source: RHB Securities Research - 22 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024