FKLI - Testing Immediate Resistance

rhboskres

Publish date: Mon, 28 Jan 2019, 11:35 AM

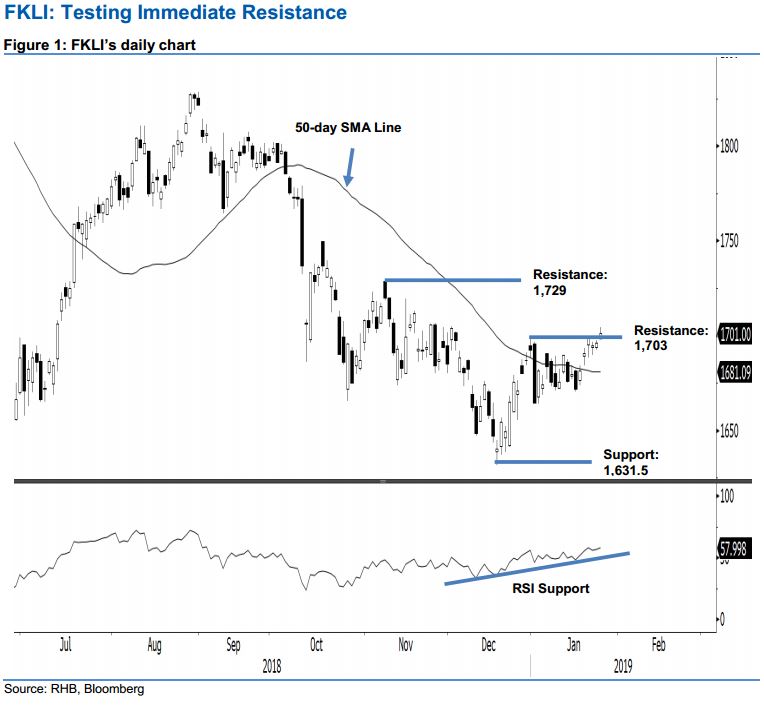

Maintain short positions as the index failed to capture the immediate resistance at the closing. The FKLI formed a white candle to settle at 1,701 pts, indicating a gain of 5 pts. At one point, it briefly crossed the immediate resistance mark of 1,703 pts, with an intraday high of 1,704.5 pts. The day’s low was at 1,698 pts. As mentioned before, a close above the said immediate resistance would also signal a decisive breakout from the 50-day line. With that, the rebound that started from the low of 1,631.5 pts on 218 Dec 2018 is likely to resume. Pending such a confirmation, we are sticking to our negative trading tone.

Until there is a switch in our bias, traders should remain in short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be placed above 1,703 pts.

Immediate support is maintained at 1,631.5 pts, the low of 18 Dec. The second support is expected at the 1,600- pt mark. Conversely, the immediate resistance is still expected at 1,703 pts, the high of 31 Dec 2018. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 28 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024