Hang Seng Index Futures: Taking a Breather

rhboskres

Publish date: Wed, 30 Jan 2019, 04:34 PM

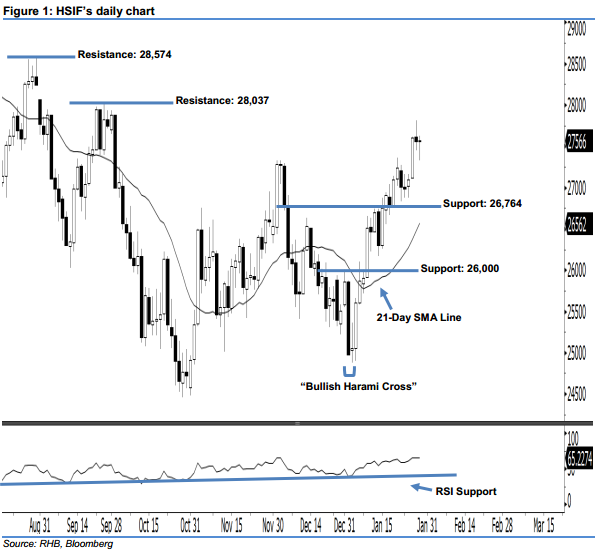

Stay long, with a trailing-stop set below the 26,764-pt support. The HSIF formed a “Doji” candle with a long lower shadow yesterday. During the intraday session, it dropped to a low of 27,325 pts before ending at 27,566 pts for the day. Technically, it is not surprising that buyers may be taking a breather following the recent gains. Yesterday’s long lower shadow implied that there was initial selling pressure during the day before the market moved up by the end of the trading session. This indicated that the market outlook remained positive.

Based on the daily chart, we are eyeing the immediate support at 26,764 pts, which was the low of 18 Jan. The next support is maintained at the 26,000-pt psychological spot. On the other hand, the immediate resistance is seen at 28,037 pts, ie the previous high of 26 Sep 2018. If a breakout arises, look to 28,574 pts – determined from the high of 30 Aug 2018 – as the next resistance.

As a result, we advise traders to maintain long positions, given that we initially recommended initiating long above the 26,000-pt level on 10 Jan. In the meantime, a trailing-stop can be set below the 26,764-pt mark to lock in part of the gains.

Source: RHB Securities Research - 30 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024