FKLI - Bulls on the Defensive

rhboskres

Publish date: Tue, 12 Feb 2019, 09:22 AM

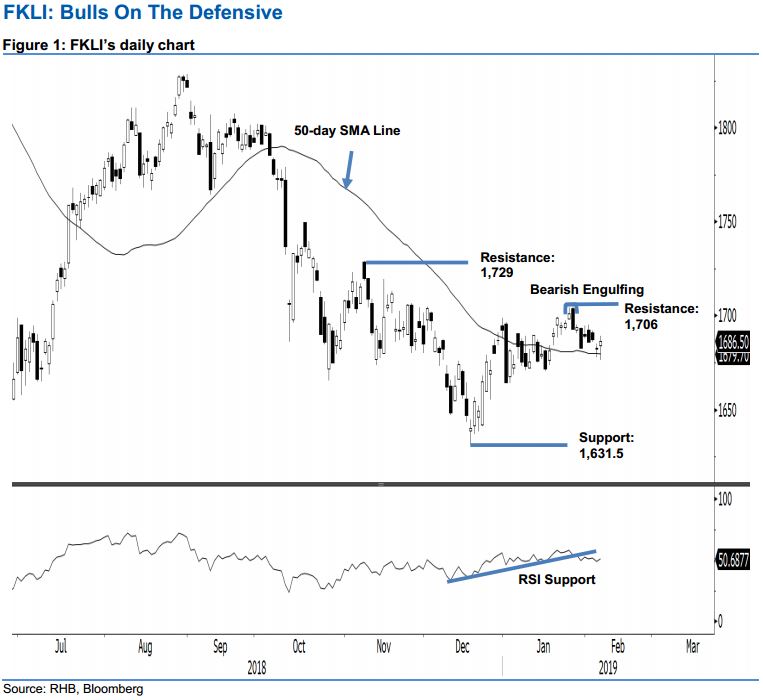

Maintain short positions as the 50-day SMA line is being challenged by the bears. The FKLI reversed the earlier session’s weak tone to close 3.5 pts higher, at 1,686.5 pts. It challenged the 50-day SMA line again – with the intraday low at 1,676.5 pts, and high at 1,689 pts. While the bulls defended the SMA line for the second consecutive session, there were no clear price actions suggesting the negative bias that started from 29 Jan’s “Bearish Engulfing’ formation has ended. As such, we maintain our negative trading bias.

As the downside bias is still being played out, we continue to recommend that traders maintain short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be paced above 1,706 pts.

Immediate support is expected at 1,631.5 pts, the low of 18 Dec 2018. This is followed by the 1,600-pt mark. On the other hand, the immediate resistance is eyed at 1,706 pts, the high of the 28 Jan’s “Bearish Engulfing” formation. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 12 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024