E-mini Dow Futures - Uptrend Stays Intact

rhboskres

Publish date: Tue, 12 Feb 2019, 09:30 AM

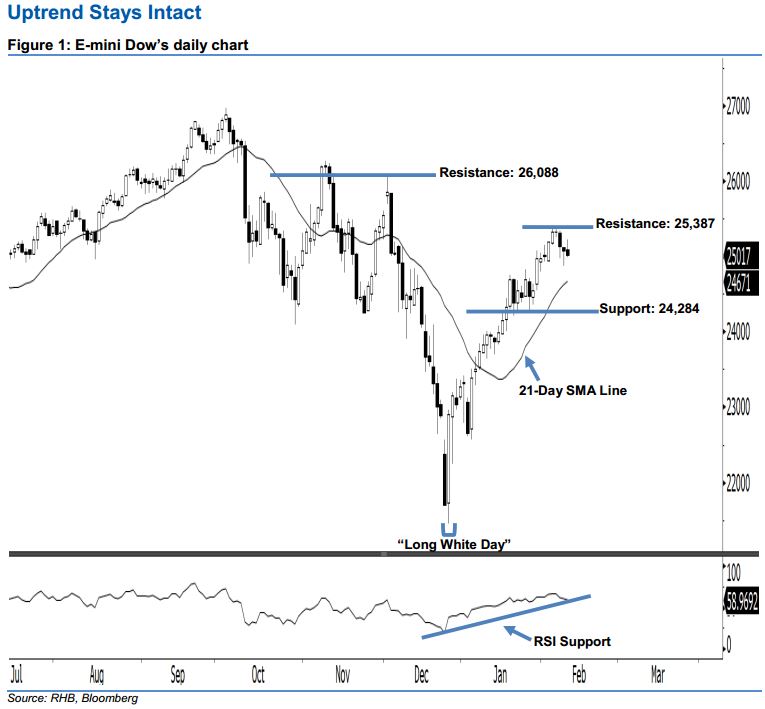

Bullish outlook stays intact; stay long. The E-mini Dow ended lower to form a black candle last night. It declined 64 pts to close at 25,017 pts, after oscillating between a high of 25,226 pts and low of 24,981 pts. Technically speaking, yesterday’s black candle can be viewed as a result of profit-taking activities following recent gains seen last week. With the 21-day SMA line still pointing upwards, we believe the upside swing that started off 26 Dec 2018’s “Long White Day” candle may continue. Overall, we remain bullish on the E-mini Dow’s outlook.

As seen in the chart, the immediate support is seen at 24,284 pts, ie near the lows of 23 and 28 Jan. The next support is anticipated at the 24,000-pt psychological mark. On the other hand, we are eyeing the immediate resistance at 25,387 pts, which was the high of 6 Feb. If a decisive breakout arises, look to 26,088 pts – obtained from the previous high of 3 Dec 2018 – as the next resistance.

Hence, we advise traders to maintain long positions, since we initially recommended initiating long above the 22,400-pt level on 27 Dec 2018. A trailing-stop can be set below the 24,284-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 12 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024