FCPO - Bulls Fail To Engineer Rebound

rhboskres

Publish date: Thu, 14 Feb 2019, 05:45 PM

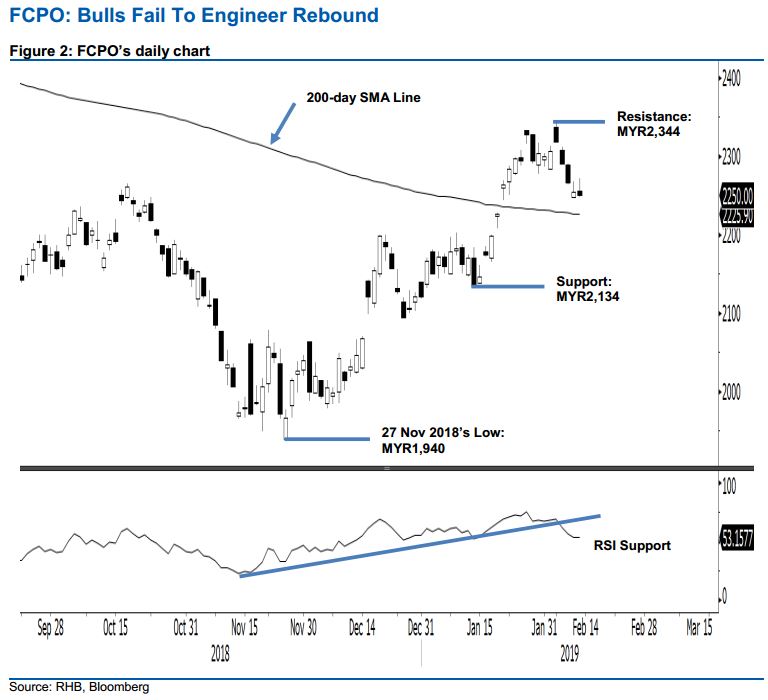

Maintain short positions as the bulls failed to engineer a rebound. The FCPO ended the latest session slightly lower by MYR4 at MYR2,250. This was after it failed to sustain to its earlier session’s gains, which saw it hit a high of MYR2,272 and low of MYR2,248. Overall, we believe chances are still high for the commodity to retrace further – correcting its upward move that happened from the low of MYR1,940 on 27 Nov 2018 until the recent high of MYR2,344 on 7 Feb. Our minimum target for this retracement is for it to retest the 200-day SMA line. As such, we maintain our negative trading inclination.

Given the failure of the bulls to engineer a rebound in the latest session – indicative that the retracement leg is still fully in force – traders should stay in short positions. These were initiated at MYR2,290, the closing level of 8 Feb. To manage risks, a stop-loss can be placed above MYR2,344.

The immediate support is expected at MYR2,200, a round figure. Breaking this could see the commodity retrace towards MYR2,134, the low of 14 Jan. Moving up, the immediate resistance is expected at MYR2,344, the high of 7 Feb. This is followed by MYR2,400.

Source: RHB Securities Research - 14 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024