FCPO - Long Term Downtrend Still a Hurdl

rhboskres

Publish date: Fri, 22 Feb 2019, 05:38 PM

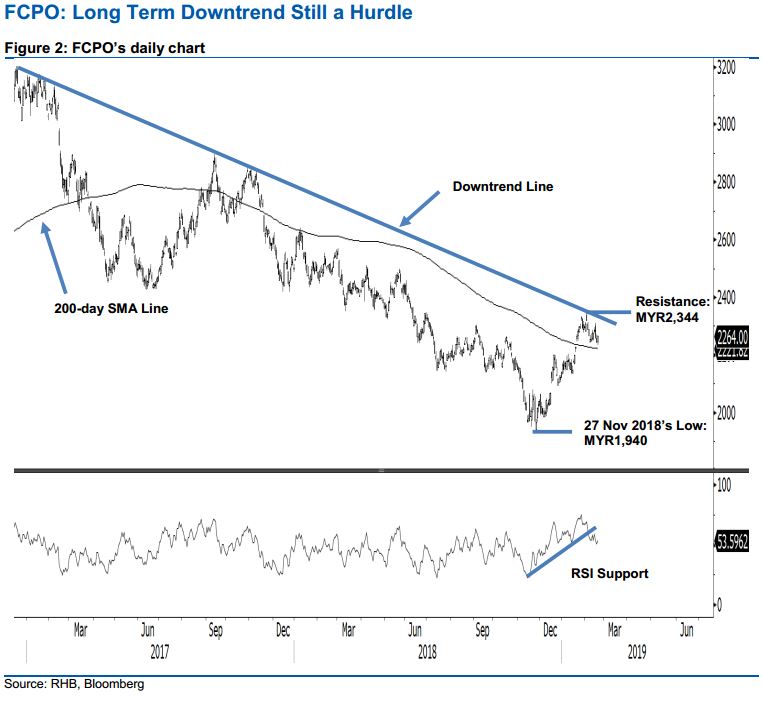

Maintain short positions until the road is crossed. We think the time is right for us to take a look into the FCPO's long-term price chart. Overall, the commodity remains trading below its long-term downtrend line – stretching from Dec 2016’s high. On the back of the overbought daily RSI reading, the commodity failed to crack above this downtrend line on 7 Feb. Since then, prices have retraced towards the 200-day SMA line – our minimum target area yesterday. So far, the retracement still look corrective with no technical damage inflicted on the upward price trajectory that started from the low of MYR1,940 on 27 Nov 2018 – a decisive breakdown from said SMA line could alter this technical landscape. At a lower time-frame, we saw positive price reactions in the latest session from the said SMA area, but it is still too early to suggest that a total price reversal is imminent. Its daily RSI reading has also reset to a healthy level. All in, further positive price actions are needed in the coming sessions to suggest the 2-week retracement has reached an end, and that the commodity is ready for another breakout attempt from the long term downtrend line. Until we see signs of this possibility developing, we maintain our negative trading bias.

We continue to suggest traders to maintain short positions. These were initiated at MYR2,290, the closing level of 8 Feb. To manage risks, a stop-loss can be placed above MYR2,344.

The immediate support is pegged at the MYR2,200 mark. This is followed by MYR2,134, the low of 14 Jan. Moving up, the immediate resistance is expected at MYR2,344, the high of 7 Feb. This is followed by MYR2,400.

Source: RHB Securities Research - 22 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024