FKLI - Bulls Taking a Pause

rhboskres

Publish date: Fri, 22 Feb 2019, 05:39 PM

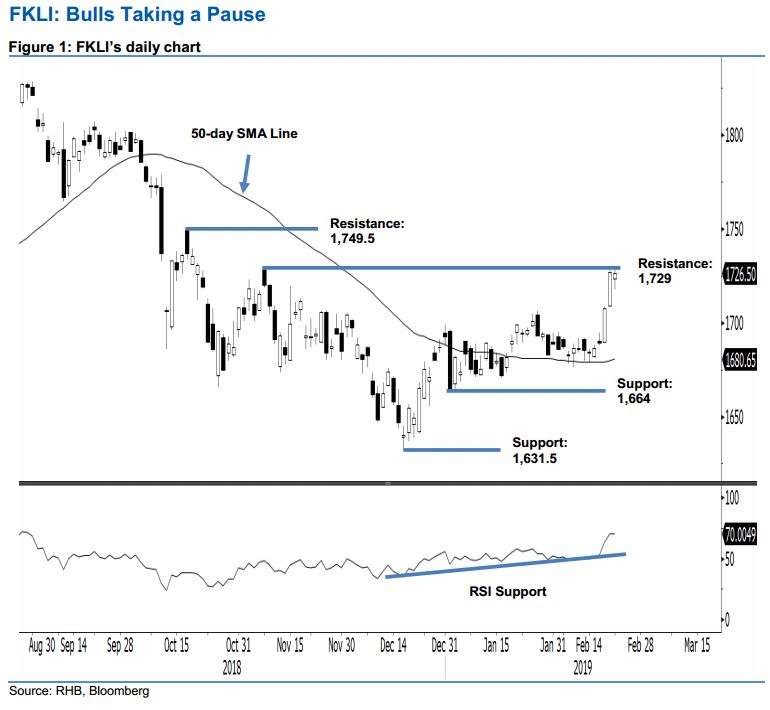

Pausing near the immediate resistance; maintain long positions. The FKLI ended the latest session marginally lower by 0.5 pts at 1,726.50 pts - as it managed to recoup most of its intraday loses and at one point, tested the 1,729-pt immediate resistance. The session’s low and high were registered at 1,717.5 pts and 1,729.50 pts. The intraday reversal and the attempt to breach above the said immediate resistance are indicating the index’s underlying strength remains intact. While the daily RSI is entering the overbought zone, we are not seeing it as a major concern for now until there is negative price confirmation. Maintain our positive trading bias.

As the index continues to show resiliency near the immediate resistance ie not flashing out price rejection signals, we continue to recommend traders to stay in long positions. We recommended these positions at 1,707.5 pts, the closing level of 19 Feb. For risk management purposes, the trailing-stop is revised to the breakeven level.

The immediate support is set at 1,664 pts, which is the low of 2 Jan. This is followed by 1,631.5 pts, the low of 18 Dec 2018. Moving up, the immediate resistance is now set at 1,729 pts, the high of 8 Nov. This is followed by 1,749.5 pts, the high of 17 Oct 2018.

Source: RHB Securities Research - 22 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024