Hang Seng Index Futures - Third Consecutive White Candle

rhboskres

Publish date: Mon, 25 Feb 2019, 10:30 AM

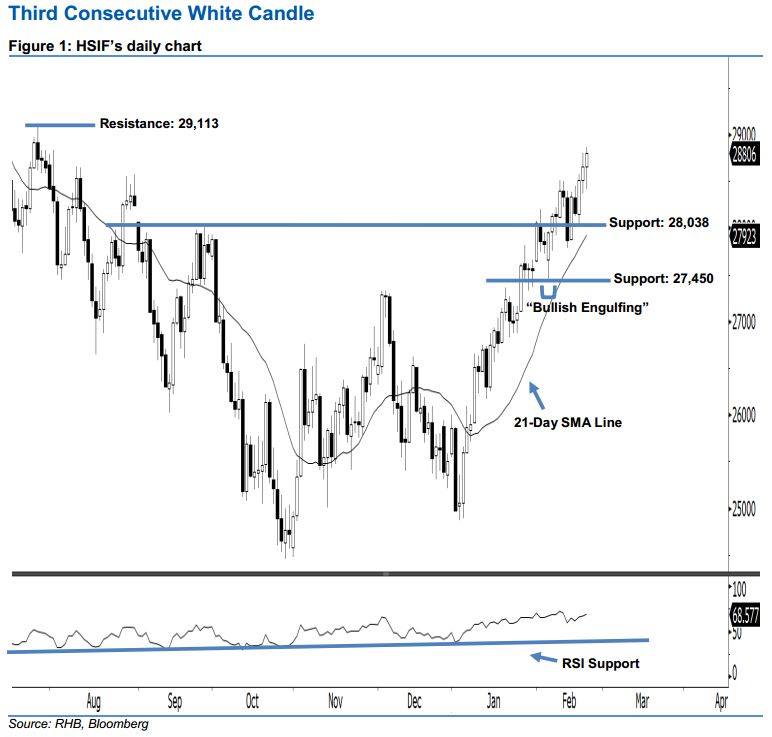

Stay long, with a new trailing-stop set below the 28,038-pt level. Last Friday, the HSIF’s upward momentum continued as expected, after it formed another white candle. It closed at 28,806 pts, after oscillating between a high of 28,864 pts and low of 28,417 pts. Based on the current technical landscape, the bullish trend is likely to continue in the coming sessions, as the index has marked higher closes accordingly since 20 Feb. With the 21- day SMA line edging upwards, this also implies a bullish outlook sentiment.

As seen in the chart, we are now eyeing the immediate support level at 28,038 pts, ie the low of 20 Feb. If a breakdown arises, look to 27,450 pts – which was the low of 8 Feb’s “Bullish Engulfing” pattern – as the next support. To the upside, the immediate resistance level is anticipated at 29,113 pts, which was the previous high of 26 Jul 2018. The next resistance would likely be at the 30,000-pt psychological mark.

To re-cap, on 10 Jan, we initially recommended traders to initiate long positions above the 26,000-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 28,038-pt threshold in order to lock in a larger part of the profits.

Source: RHB Securities Research - 25 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024