COMEX Gold - Tightening the Trailing-Stop

rhboskres

Publish date: Mon, 25 Feb 2019, 10:35 AM

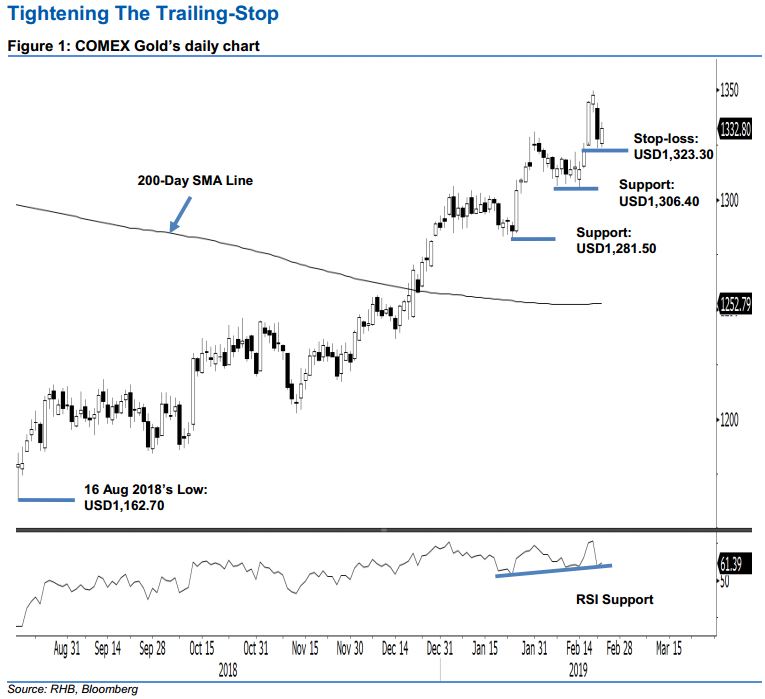

Maintain long positions while moving up the trailing-stop. The yellow metal posted a rebound in the latest trading session after it experienced a sharp decline in the prior one. Session’s low and high were recorded at USD1,323.80 and USD1,335.60, before closing at USD1,332.80, indicating a decline of USD5. Overall, the commodity’s upward move that started from the low of USD1,162.70 on 16 Aug 2018 remains intact. While the prior session’s sharp drop came on the back of the overbought Daily RSI reading, further negative price actions are needed to signal that a deeper retracement is in play. Until this happens, we keep to our positive trading tone.

Until there are further negative follow-ups on the prior session’s black candle, we continue to advise traders stay in long positions. We initiated this at the USD1,216 level, which was 14 Nov 2018’s close. For risk management purposes, a stop-loss can now be placed below the USD1,323.30 mark.

Immediate support is set at USD1,306.40, which was the low of 7 Feb. This is followed by USD1,281.50, the low of 24 Jan. On the other hand, the immediate resistance is expected at USD1,370.50, which was the high of 25 Jan 2018. This is followed by USD1,400, a round figure.

Source: RHB Securities Research - 25 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024