COMEX Gold - No Deeper Retracement Signals Yet

rhboskres

Publish date: Tue, 26 Feb 2019, 10:50 AM

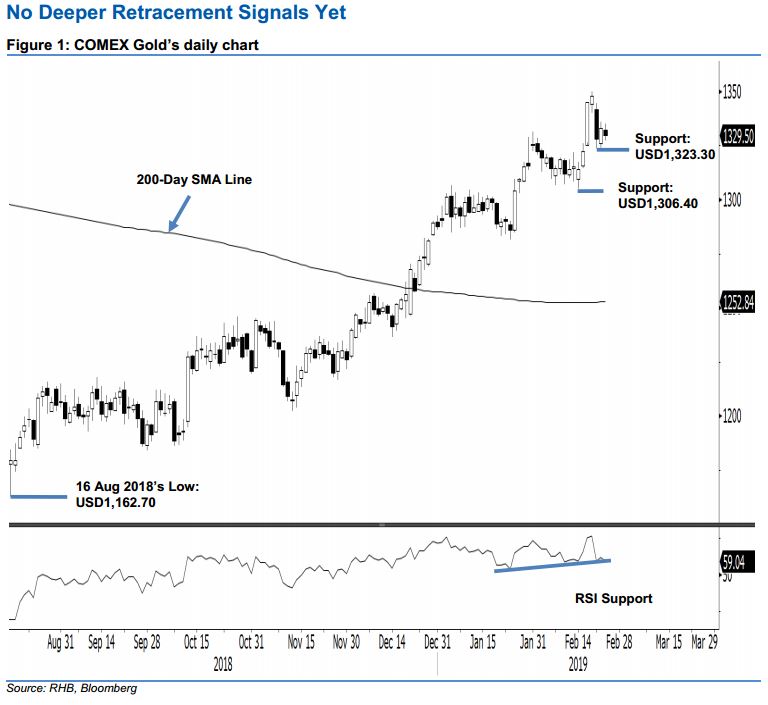

Maintain long positions until deeper risk of deep price retracement is confirmed. The precious metal ended the latest session on the weak side – declining USD3.30 to settle at USD1,329.50, as it failed to maintain its earlier session’s gain. The day’s trading range was between USD1,327.30 and USD1,334.90. The weak session means there was no positive follow-up from the prior session’s rebound – indicating lack of strength on the side of the bulls – to push the commodity higher at this juncture. A downside breach of the immediate support of USD1,323.30 would likely signal that a deeper retracement is developing – as a correction for the commodity’s upward move that started from the low of USD1,162.70 on 16 Aug 2018. Until this happens, maintain long bias.

As there are no price signals to suggest the upward move has reached an end, we continue to advise traders stay in long positions. We initiated this at the USD1,216 level, which was 14 Nov 2018’s close. For risk management purposes, a stop-loss can now be placed below the USD1,323.30 mark.

Towards the downside, the immediate support is revised to USD1,323.60, the low of 21 Feb. This is followed by USD1,306.40, which was the low of 7 Feb. Moving up, the immediate resistance is expected at USD1,370.50, which was the high of 25 Jan 2018. This is followed by USD1,400, a round figure.

Source: RHB Securities Research - 26 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024