FCPO - Retracement Intensifying

rhboskres

Publish date: Wed, 27 Feb 2019, 05:25 PM

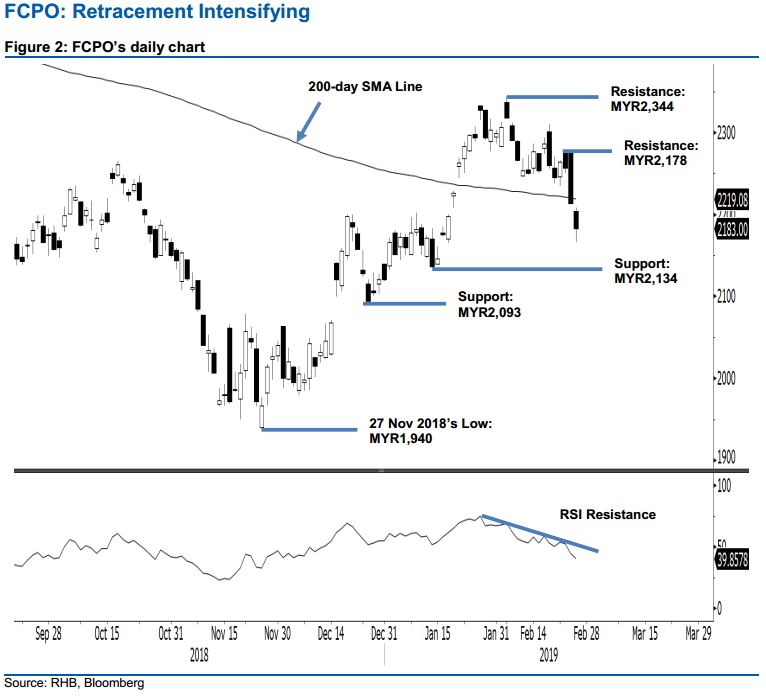

Maintain short positions while revising the trailing-stop to the positive. The FCPO formed another black candle in the latest session – at the closing, it breached below the previous immediate support of MYR2,200. Intraday price movements were negative, as it generally moved lower for the whole session, with the high and low recorded at MYR2,208 and MYR2,166 before closing at MYR2,183, indicating a decline of MYR30. The firm breach of both the 200-day SMA line and the said previous immediate support signal the retracement leg is continuing to develop without showing any signs of exhaustion. Until we see signs that the commodity is reaching an end of this retracement, we maintain our negative trading bias.

As the bears are firmly in control over the retracement leg, we continue to suggest that traders maintain short positions. These were initiated at MYR2,290, the closing level of 8 Feb. To manage risks, a trailing-stop can be placed above MYR2,178.

The immediate support is revised to MYR2,134, the low of 14 Jan. This is followed by MYR2,093, which was the low of 26 Dec 2017. Moving up, the immediate resistance is now expected at MYR2,178, the high of 25 Feb. This is followed by MYR2,344, the high of 7 Feb.

Source: RHB Securities Research - 27 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024