Hang Seng Index Futures: Sentiment Remains Bullish

rhboskres

Publish date: Thu, 28 Feb 2019, 05:44 PM

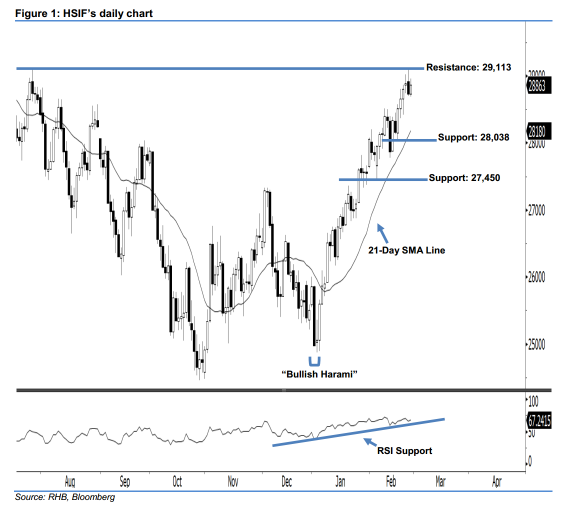

Bullish outlook stays intact; stay long. The HSIF ended higher to form a white candle yesterday. It closed at 28,863 pts, after oscillating between a high of 28,959 pts and low of 28,685 pts. From a technical perspective, the bullish sentiment stays intact, as the index continues to hold above the rising 21-day SMA line. In addition, the 14- day RSI indicator is now rising higher without being overbought, this indicates that the HSIF may further extend the rebound from 3 Jan’s “Bullish Harami” pattern. Overall, we remain bullish on the HSIF’s outlook.

As seen in the chart, the immediate support level is seen at 28,038 pts, determined from the low of 20 Feb. Meanwhile, the next support would likely be at 27,450 pts, ie the previous low of 8 Feb. Towards the upside, we are eyeing the immediate resistance level at 29,113 pts, which was the high of 26 Jul 2018. If a decisive breakout arises, the next resistance is maintained at the 30,000-pt psychological spot.

Hence, we advise traders to maintain long positions, given that we previously recommended initiating long above the 26,000-pt level on 10 Jan. A trailing-stop is advisable to set below the 28,038-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 28 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024