FKLI & FCPO: FKLI: Still Resembles a Minor Consolidation

rhboskres

Publish date: Thu, 28 Feb 2019, 05:52 PM

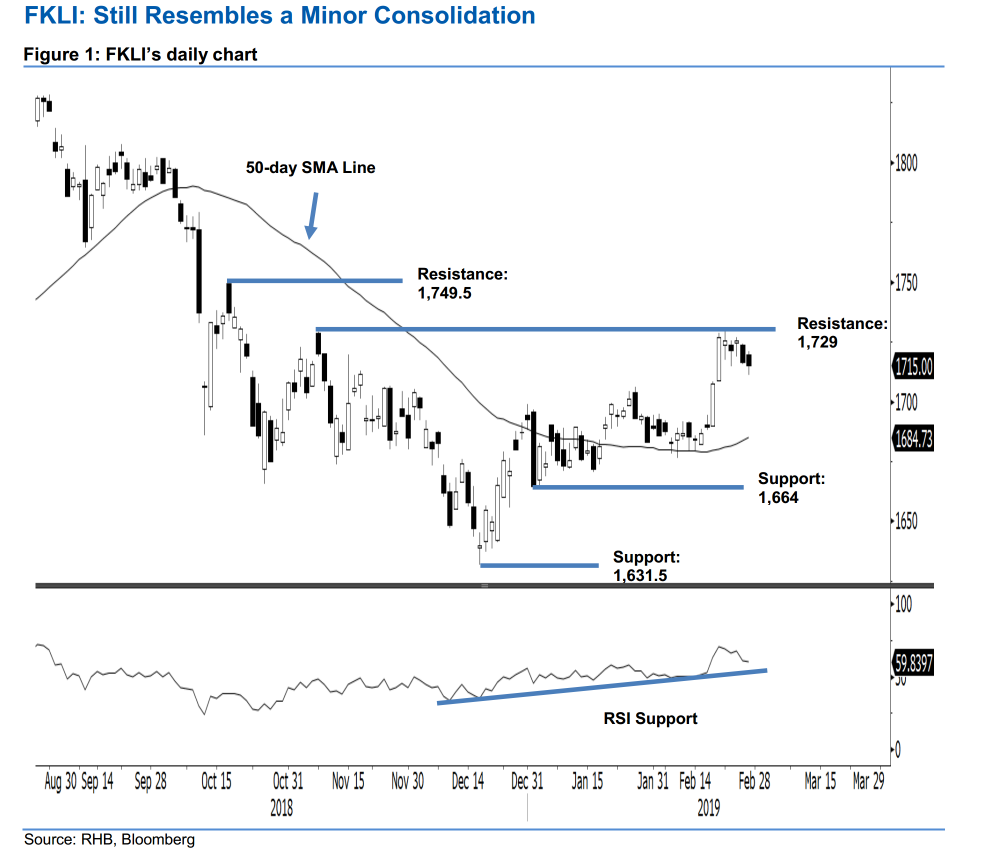

Maintain long positions, as there is no sign of a price reversal. The FKLI failed to sustain its earlier session’s positive momentum, and closed at 1,715 pts yesterday, indicating a marginal dip of 1.5 pts. The high and low were at 1,721 pts and 1,711 pts. We note that its consolidation phase, under the immediate resistance of 1,729 pts, is still developing. At present, there is no evidence to indicate this consolidation phase will take shape in the form of a deeper retracement. Hence, we keep to our positive trading bias.

As the rebound may still be extending, traders are advised to maintain long positions. We initiated these at 1,707.5 pts, the closing level of 19 Feb. To manage risks, the trailing-stop is at the breakeven level. The immediate support is at 1,664 pts, the low of 2 Jan. Breaking this may see the market test 1,631.5 pts, the low of 18 Dec 2018. On the other hand, the overhead resistance is expected at 1,729 pts, the high of 8 Nov. This is followed by 1,749.5 pts, the high of 17 Oct 2018.

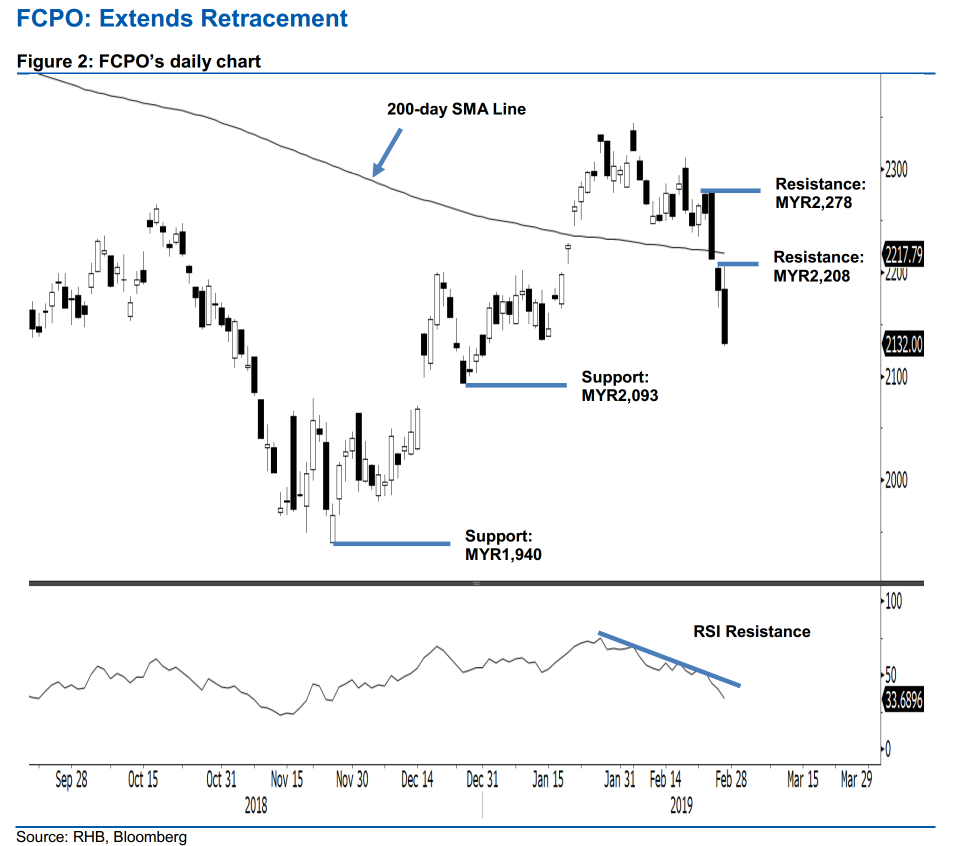

Maintain short positions while keeping the trailing-stop even tighter. The FCPO performed weakly yesterday and, at the closing, slipped under the previous immediate support of MYR2,134. Generally, it trended lower for the whole session, sliding from a high of MYR2,208 to a low of MYR2,129, before ending at MYR2,132, indicating a decline of MYR51. The retracement continued to be extended after the 200-day SMA line was breached recently. In the absence of a price reversal or rebound signal, chances are still high that the extension will continue. As such, we maintain our negative trading bias.

The recent decline has been relatively sharp and some form of consolidation or rebound is normally expected. In the absence of such price signals, however, traders can remain in short positions. These were initiated at MYR2,290, the closing level of 8 Feb. To manage risks, a trailing-stop is revised to MYR2,208, the high of the latest session

The immediate support is now at MYR2,093, the low of 26 Dec 2017. This is followed by MYR1,940, the low of 27 Nov 2018. Conversely, the immediate resistance is now pegged at MYR2,208, the latest session’s high. This is followed by MYR2,278, the high of 25 Feb.

Source: RHB Securities Research - 28 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024