COMEX Gold: Trailing-Stop Hit

rhboskres

Publish date: Fri, 01 Mar 2019, 04:44 PM

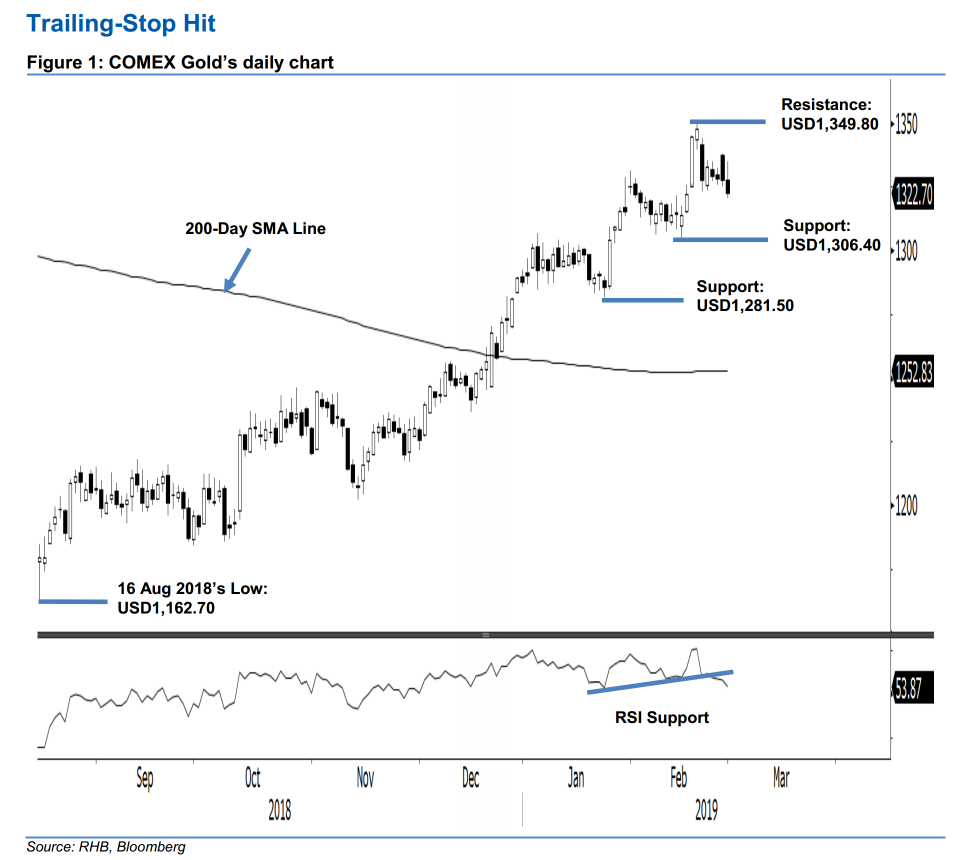

Initiate short positions on the expectation that a short-term consolidation phase is developing. The Comex Gold ended the latest session weaker by USD5.20 at USD1,322.70 – breaking our previous immediate support of USD1,323.30. The low and high were posted at USD1,320.60 and USD1,335. The breakdown from the said previous support can be seen as a continuation of 21 Feb’s relatively sharp decline. This signals that chances are high that the commodity is now entering a consolidation phase to correct its multi-month upward move that started from the low of USD1,162.70 on 16 Aug 2018. Switch our trading call to negative.

Our previous long position that we initiated at the USD1,216 level, the closing level of 14 Nov 2018, was closed out in the latest session at USD1,323.30. On the bias that a correction phase is now developing, we initiate short positions at the latest closing. For risk management purposes, a stop-loss can be placed above USD1,349.80.

Immediate support is revised to USD1,306.40, which was the low of 7 Feb. This is to be followed by USD1,281.50, which was the low of 24 Jan 2018. Overhead resistance is now pegged at USD1,349.80, the high of 20 Feb 2018. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 1 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024