FKLI & FCPO: FKLI: Bulls Take a Pause

rhboskres

Publish date: Fri, 01 Mar 2019, 04:53 PM

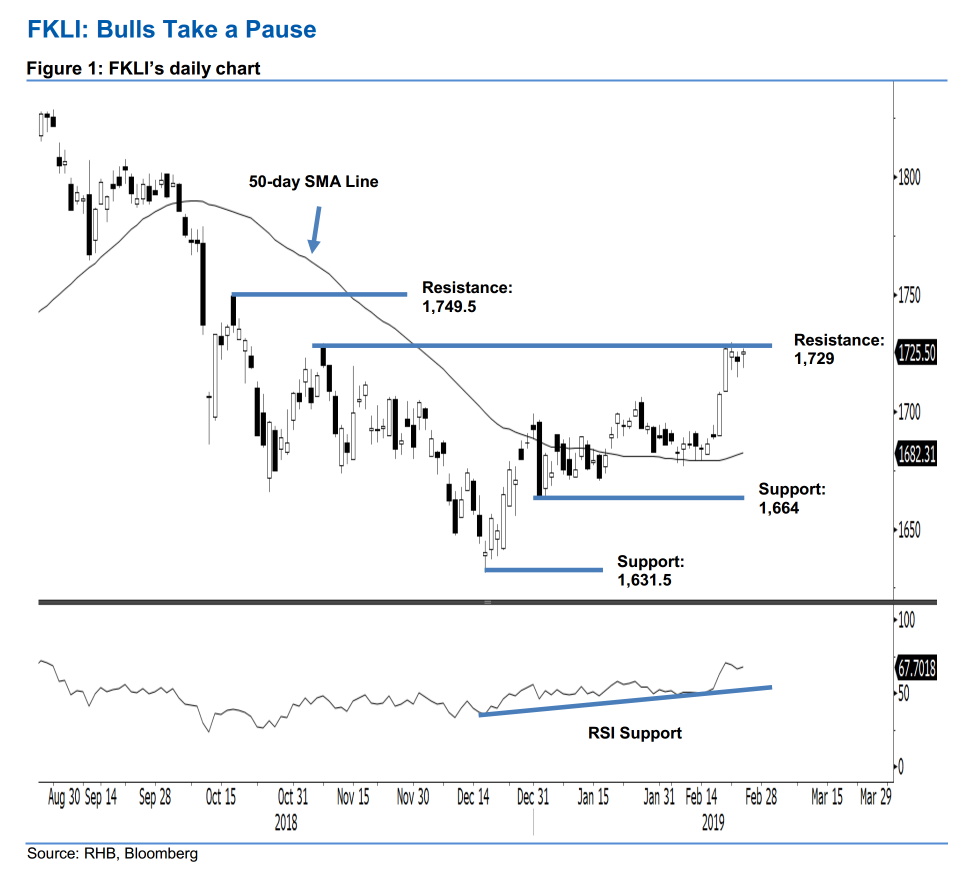

Still resembling a consolidation near the immediate resistance; maintain long positions. The FKLI dipped 4 pts to close at 1,725.5 pts yesterday, with the low and high at 1,718.5 pts and 1,727 pts. The index’s latest three sessions’ price actions – near the immediate resistance of 1,719 pts – resemble the characteristics of a consolidation phase. This is deemed healthy for a correction of its recent rebound from the 50-day SMA line – which was relatively sharp. Overall, with no price reversal signals spotted near the immediate resistance, we keep to our positive trading bias.

As the consolidation is showing healthy signs of developing, we continue to recommend that traders stay in long positions – at 1,707.5 pts, the closing level of 19 Feb. To manage risks, the trailing-stop is revised to the breakeven level.

Immediate support is maintained at 1,664 pts, the low of 2 Jan. Breaking this may see the market challenge 1,631.5 pts, the low of 18 Dec 2018. Moving up, the immediate resistance is set at 1,729 pts, the high of 8 Nov. This is followed by 1,749.5 pts, the high of 17 Oct 2018.

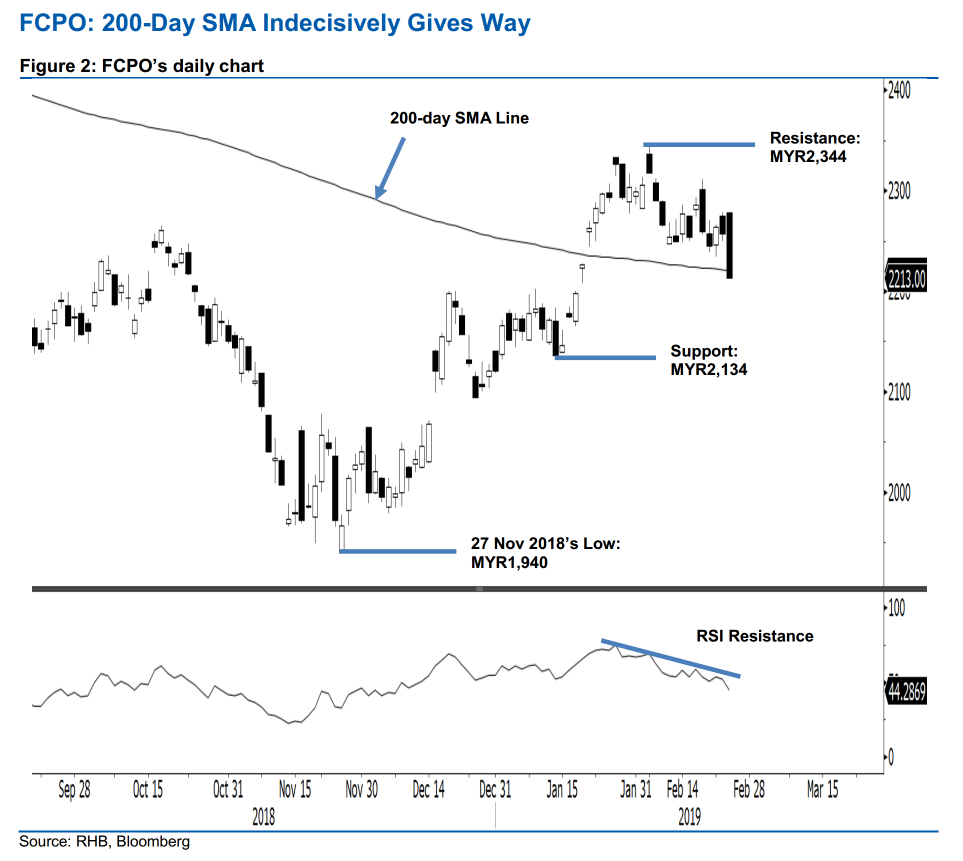

Retracement phase still not showing signs of ending; maintain short positions. The FCPO trended lower yesterday, and closed at the day’s low of MYR2,213, indicating a decline of MYR44. The high was at MYR2,278. The intraday reversal and the breakdown from the 200-day SMA line – albeit marginally – indicates that the retracement that started from the high of MYR2,344 on 7 Feb is still firmly in place. The downside risk may increase if the commodity fails to regain ground above the SMA line in the coming sessions. Hence, we maintain our negative trading tone.

As the retracement leg is still progressing and the giveaway of the SMA line lends strength to this bias, we continue to suggest that traders maintain short positions. These were initiated at MYR2,290, the closing level of 8 Feb. To manage risks, a stop-loss can be placed above MYR2,344.

The immediate support is maintained at the MYR2,200 mark. The following support is expected to emerge at MYR2,134, the low of 14 Jan. Conversely, the immediate resistance is set at MYR2,344, the high of 7 Feb. This is followed by MYR2,400.

Source: RHB Securities Research - 1 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024