E-mini Dow Futures - Outlook Remains Bullish

rhboskres

Publish date: Mon, 04 Mar 2019, 09:18 AM

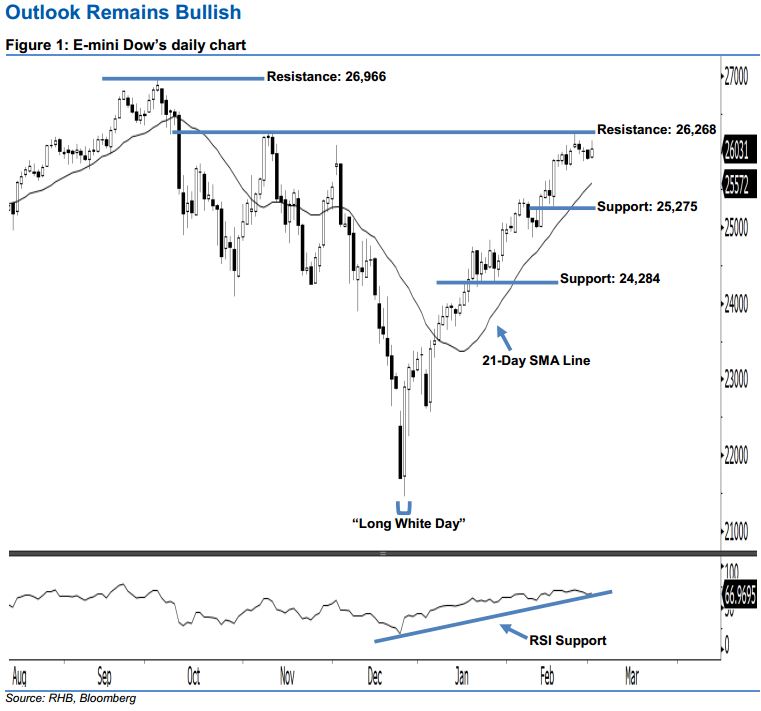

Stay long. The E-mini Dow ended higher to form a white candle last Friday. It rose 118 pts to close at 26,031 pts, after oscillating between a high of 26,143 pts and low of 25,894 pts. As the E-mini Dow has marked a higher close above the rising 21-day SMA line, this can be viewed as the bullish sentiment staying intact. In view of the fact that the 14-day RSI indicator is now rising higher without being overbought, this indicates that the upside swing that began from 26 Dec 2018’s “Long White Day” candle may go on.

Based on the daily chart, the immediate support level is seen at 25,275 pts, which was the low of 15 Feb’s long white candle. If a decisive breakdown arises, the next support is maintained at 24,284 pts, ie near the lows of 23 and 28 Jan. On the other hand, we anticipate the immediate resistance level at 26,268 pts, obtained from the high of 8 Nov 2018. Meanwhile, the next resistance would likely be at the 26,966-pt historical high.

Thus, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 22,400-pt level on 27 Dec 2018. At the same time, a trailing-stop can be set below the 25,275-pt mark in order to lock in part of the profits.

Source: RHB Securities Research - 4 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024