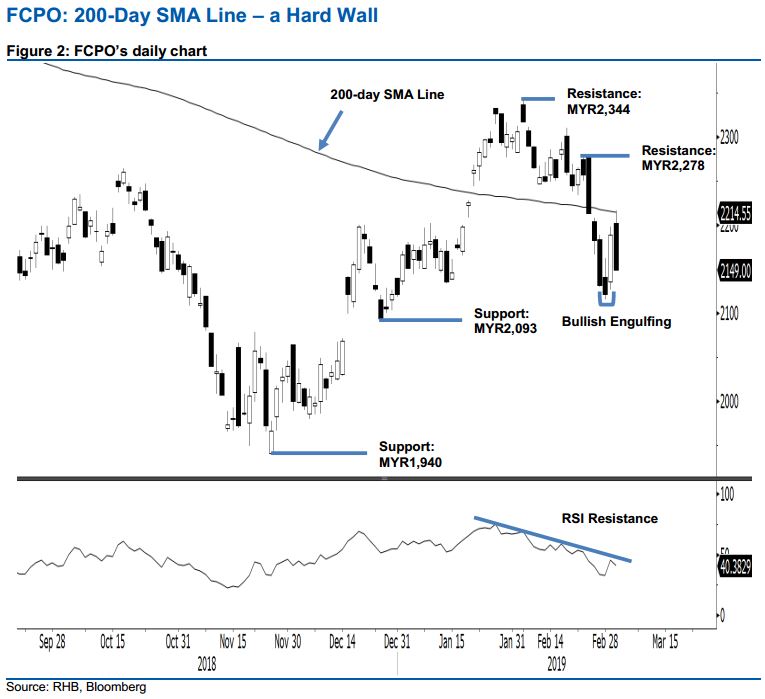

FCPO - 200-Day SMA Line – a Hard Wall

rhboskres

Publish date: Tue, 05 Mar 2019, 09:48 AM

Maintain long positions. The FCPO experienced a sharp intraday negative price reversal in the latest session – after it tested the 200-day SMA line in the earlier part of the session. The commodity generally moved lower for the whole session – the high and low were posted at MYR2,217 and MYR2,148, before it ended MYR40 weaker at MYR2,149. The sharp negative reaction from the 200-day SMA line suggests a price rejection from the said level. However, it is still too early to suggest the rebound that started from the low of MYR2,115 on 28 Feb, has reached an end, and that the commodity is at the risk of resuming its retracement leg. Based on this, we still maintain our positive bias.

As we see the commodity is in the process of, at the very minimum, developing a deeper rebound, we continue to suggest traders to keep to long positions. These positions were opened at MYR2,189, the closing level of 1 Mar. To manage risks, a stop-loss can be placed below MYR2,115, the low of 28 Feb.

The immediate support is expected at MYR2,093, the low of 26 Dec 2017. Breaking this may see the market test MYR1,940, the low of 27 Nov 2018. Conversely, the immediate resistance is now set at MYR2,278, the high of 25 Feb. This is followed by MYR2,344, which was the high of 7 Feb.

Source: RHB Securities Research - 5 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024